Summary: It's not well understood, but the majority of ASX CEFs only came into existence due to selling fees (typically 1-2%) paid to financial advisors and brokers to push them on retail investors. In July 2013, selling commissions (known as stamping fees) were banned for most investment products (e.g. managed funds) but LICs and LITs were left exempt. Fund managers and financial planners/brokers then cashed in on launching billions in new ASX LIC and LIT funds.

Finally, in July 2020, this exemption was fixed. Since then, only 5 Closed End Funds (CEFs) have listed (WAR, SB2, TVL, CDO, HCF). All five trade at significant, persistent discounts, and their rapid descent reveal the perilous times ahead for ASX CEFs.

In the same period, 35 CEFs have wound up due to their underperformance and intractable discounts. So, yes, ASX CEFs are dying! In this post, I discuss how selling commissions are so linked to the fortunes of the ASX CEF industry, and why it is now destined to slowly die without them. Natural, ongoing demand for an investment product is needed.

|

Details:

See also: > CaptiveCapital's 95 theses on why ASX Closed End Funds should be eliminated

1. The dirty secret of ASX CEF selling fees (stamping fees)

In July 2013, the Future of Financial Advice (FoFA) reforms banned commissions being paid to financials planners for putting their clients into managed funds. But comissions for listed Closed End Funds (LICs and LITs) were still allowed! No surprise, fund managers rushed to launch Closed End Funds and many financial planners and brokers greedily cashed in on the party.

Most ASX CEF investors have no idea about this history. You can read more of it here: > Firstlinks: Authorities reveal disquiet over LIC fees.

Why would an adviser put clients into a new LIC or LIT when there are hundreds of similar choices readily available if not for the incentive of earning the selling fee?

In August 2019, 42 out of 48 of the LICs and LITs listed on the ASX since 2015 had paid selling fees to brokers and advisors to get their clients to invest. The fees mostly ranged from 1% to 2.5%, though a couple were 5%. The lack of consumer protection from government, regulators (ASIC) and the ASX is appalling.

Finally, in July 2020, this astonishing CEF loophole was eliminated and LIC/LIT selling commissions were banned too. Ever since these conflicted selling fees were banned, the launch of ASX CEFs simply stopped in its tracks:

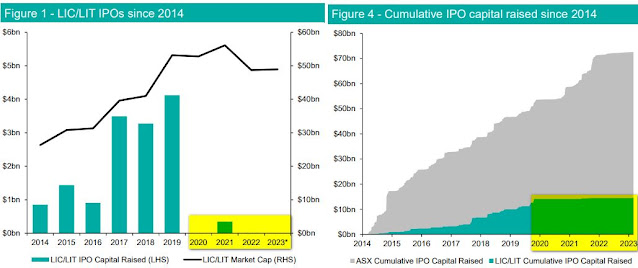

It was incriminating for many (but far from all) financial advisers and stockbrokers when the banning of stamping fees closed the Listed Investment Company (LIC) and LIT new issue market in 2020. As the chart below shows, a record amount of over $4 billion was invested in new LICs and LITs during 2019, up from $3.3 billion the previous year. In a golden period for issuers and arrangers, over $10 billion was placed with investors in only three years. Assuming a 1% stamping fee, that was $100 million to share around. And then it stopped.

|

| Bell Potter: LIC and LIT Quarterly Mar 2023 |

2. But is there natural investor demand for the ASX CEFs that did list since 2020?

Let's do a brief review:

a. SB2. Listed 16 June 2021. 30 June 2023 Discount: 26%

b. WAR. Listed 28 June 2021. 30 June 2023 Discount: 17%

c. TVL. Listed 29 Sept 2021. 30 June 2023 Discount: 52%

d. CDO. Listed 19 Nov 2021. 30 June 2023 Discount: 7%

e. HCF: Listed 25 Oct 2022. 30 June 2023 Discount: 13%

It's pretty clear from these discounts emerging so quickly after listing that it wasn't retail investors banging down the door to get access to some alpha-generating fund otherwise inaccessible. Each of these exceptions have distinct reasons behind their listing:

- SB2 is a Significant Investor Visa scheme with land mines aplenty. See: > SB2 - Salter Brothers Emerging Companies LIC - Cheat Sheet. 90% of the shares remained with Salter Brothers at launch and are slowly being redistributed, tilting the balance of buyers and sellers.

- WAR was marketed to Wilson Asset Management's 130,000 investors and additional newsletter subscribers as a discount capture strategy but quickly underperformed itself and was left with more sellers than buyers. A discount on a discount might sound attractive in theory but it also means WAR's Total Expense Ratio (TER) is added to the TER of the funds owned.

- TVL: Afterpay Ventures raised capital to make private investments then renamed itself to Touch Ventures and listed. It's profitless tech was overvalued and writedowns have led to such a deep discount it trades below cash. Investors clearly know how hard it is to wind up an ASX CEF so early, thus the discount is reflective of fatalism that the cash will be spent on more overvalued tech companies that won't turn a profit.

- CDO was a Karl Siegling listing who is well known for his now underperforming but high franked dividend LIC: CDM. CDO had performed well for a couple of years when unlisted but duly underperformed once listed. It is following the high franked dividend tactic of CDM, but overall NTA performance is what matters, and it will overwhelm this tactic.

- HCF is 50% owned by 4 connected parties and 80% owned by just 15 shareholders. It was only launched due to this existing ownership, it didn't find new retail investors interested in it. It will be run for the interests of the major owners and there is no chance of activism to redress a large discount in future.

|

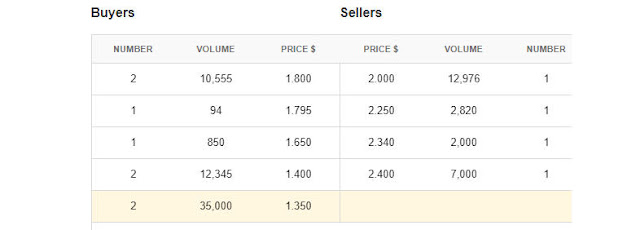

| CDO depth ladder has no liquidity to exit |

Many SMSFs and more sophisticated retail investors assemble their portfolios using ASX-listed investments, and Exchange-Traded Funds (ETFs) have now reached $60 billion, while LICs and LITs are about $50 billion.But there's a difference between the two. Demand for ETFs is primarily driven by cheap and easy access to index exposure, with many funds available for less than 10 basis points (0.1%). ETF providers devote considerable resources to investor education rather than paying promotional fees to financial advisers and brokers (there are no stamping fees paid on ETFs).How can LICs and LITs charging active fees of 1% or more compete with such low fees? Some such as Magellan rely on the long-term reputation of the manager, with a direct client base built over a decade of success, engagement and marketing effort. But managers with lower market profiles must pay selling fees to advisers to promote their products. From the manager's perspective, this is fair enough as it rewards the adviser for their distribution.Without the selling fees, many of these transactions will not come to market. If the latest review by ASIC and Treasury, and the ethical questions raised by FASEA's Code of Ethics, lead to a change in treatment of selling fees, then ETFs will receive a boost, and investors and advisers may need to focus more on unlisted funds.