Summary: The ASX is plagued with massively underperforming CEFs at huge discounts but little shareholder activism to wind them up and extract the NAV. PIA has underperformed over 19yrs, has run out of excuses, but has only just met its likely assassin in Saba Capital which just clocked 5% in July 2023.

Saba Capital will have to take on Soul Pattinson to do so, but is a genuine activist and the shareholder base is dying to rush to the exit. Wilson Asset Management has a ~7.5% stake via WAR which may passively ride the discount reversion, or a WAM fund may try and take it over.

|

| Saba Capital will take on Soul Patts to squash the persistent discount at PIA |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. PIA Key Facts

30 June 2023 Discount:

Share Price: $1.025. Pre-tax NTA: $1.255. Discount: 18.3%

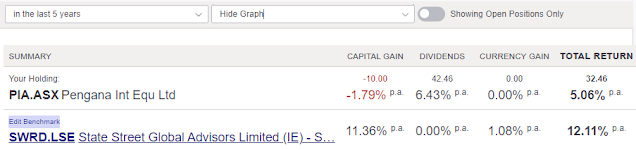

- PIA has massively underperformed its benchmark, both since inception (19 March 2004) and since the revised investment mandate (1 July 2017). As of 25th July 2023, it has trailed its benchmark ETF in Total Shareholder Return (share price plus dividends and franking) over 5yrs: 12.11% per annum to 5.06% per annum.

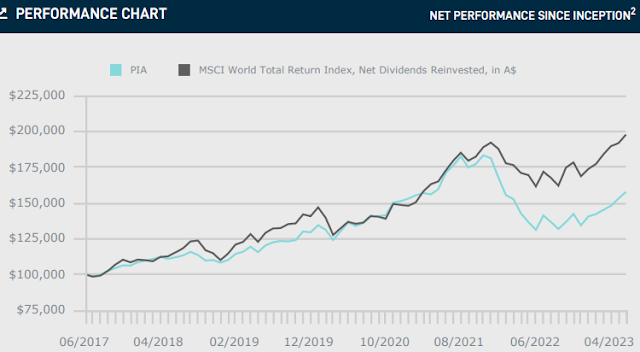

- Even its chosen performance graph shows how this massive underperformance accumulates into a difference over 5yrs of over $40,000 when starting with $100,000.

PIA June 2023 Monthly Report2. PIA Key Insight

- Yet, shockingly persistent underperformance and a huge discount isn't a sufficient catalyst for windups of ASX CEFs. You could have entered PIA anytime in the last decade at discounts over 15% and suffered both underperformance and the discount being as bad or worse when you gave up and exited.

Why is this time finally different?

- Saba Capital has form for being a particularly resolute activist at achieving CEF exits. It certainly isn't on the register to patiently wait to see what will happen in another 19 years!

> AFR - New York activist Saba Capital follows VGI Partners with Pengana buy

A substantial notice filed on Thursday afternoon shows Saba Capital began buying units in PIE in mid-March and crossing the compulsory disclosure threshold on Tuesday. Once again, Arnold Bloch Leibler lent its letterhead to the substantial notice. That indicates Saba should start ruffling feathers with the management soon, if it hasn’t already.

The playbook of Saba’s founder, Boaz Weinstein, includes pushing for funds to wind up and changing boards directors. It’s safe to assume Saba would push to close the valuation gap between PIE’s share price and the underlying portfolio. But it’s unclear how exactly it would go about it.

Geoff Wilson’s WAM has been sitting on a 7.5 per cent stake (down from 8.56 per cent) while Washington H Soul Pattison owns about 12 per cent. Wilson knows the lay of the land and should be on the same page as Saba Capital, theoretically. But Soul Patts also owns 37 per cent of Pengana Capital, has a board seat at PIE, and would be unlikely to help an interloper.

- Note that Soul Pattison's stake in PIA is a hangover from its aborted takeover of Hunter Hall International which was PIA's prior name. Soul Patt's works closely with Pengana Capital Group (PCG) and no doubt would like to see PCG retain the captive capital. However, the reputational hit of this 20yr underperformance getting a louder airing will be difficult to withstand.

- PCG already has a virtually identical unlisted, open-end version of PIA (which trades at NAV) called: Harding Loevner International Fund. An obvious proposal would be to merge it with PIA. PCG would get rid of Saba Capital (and any other arbitragers) but the loss of the complacent retail PIA funds may be slower once trading at NAV.

- PIA is heading to 20yrs since inception with enormous, accummulated underperformance. Initial 10yr Investment Management Agreements are much harder to pressure exits from. This doesn't apply to PIA and a merge into the open-end Harding Loevner International Fund is an obvious answer to all objections for more time.

What will Wilson Asset Management do?

Wilson Asset Management holds ~7.5% via WAM Strategic Value (WAR) - its discount arbitrage fund. WAR may simply ride the ~20% discount play passively. However, if PIA goes in play, WAM Global (WGB) may bid (NTA exchange ratio would be needed as WGB is at a discount) to expand fund size. WAM Capital (WAM) may bid as it trades as a premium and is an easier sell to its shareholders. PIA has excess franking credits which are always attractive to Wilson Asset Management.