Summary: ASX CEFs have existed for decades with their myriad ripoffs, pitfalls and leakages. No government agency effectively monitors and reforms the CEF industry. And if any part of the financial services industry (including media) was effective in ending unfairness, we'd have seen it. As part of my mission to eliminate ASX CEFs, CaptiveCapital is going to expose the ripoffs and embarrass the culprits. Some of these ripoffs are so indefensible, I will then go further and seek to end them all by myself.

In this case, the ripoff target is Dividend/Distribution Reinvestment Plans (DRP) at NAV when the CEF is trading at a discount! I will name and shame every CEF conducting this practice (e.g. Ophir Asset Management (OPH) which has yet to end its ripoff), follow-up to force them to quit, and monitor any new CEFs which may try and start. An updated list will be maintained in this post.

Update: As of May 2024, OPH ended this ripoff.

|

| CEF ripoffs lie waiting in every direction |

Details:

Note: Companies pay dividends, Trusts pay distributions but they have the same impact here. I use dividend to refer to both in this post.

1. What are Dividend/Distribution Reinvestment Plans (DRP)?

From > marketindex.com.au - Dividend Reinvestment Plans

A dividend reinvestment plan (DRP) is a program some companies offer that allows investors to choose between receiving a cash dividend, or automatically reinvesting their dividend payment back into the company for additional shares. Many companies offer a small discount to the current share price to encourage participation in their DRP.

2. Examples of fair or defensible DRPs

DRPs are perfectly justifiable to reduce unnecessary transactions (getting dividend cash and then manually buying back shares), improve tax efficiency, and periodically add to the share count (which may offset capital management like buybacks which reduce share count).

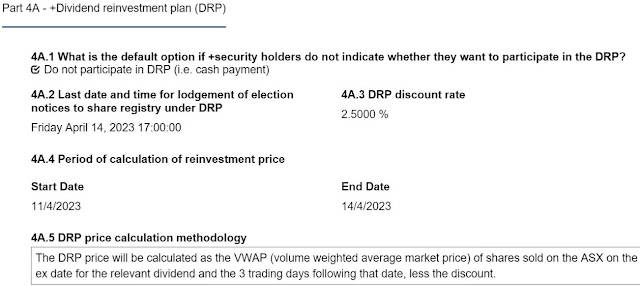

The standard price used for DRP calculations is the Volume Weighted Average Price (VWAP) over the ~5 trading days from the ex-dividend date.

A DRP discount means the shares are issued at a discount to the nominated DRP calculation price. So for most using VWAP around ex-dividend date, that would be, for example, 2.5% less.

Highly liquid and efficient stocks typically don't need discounts, and certainly not higher than 2.5%. But for stocks that aren't highly liquid and efficient, a small (~2.5%) DRP discount is defensible to reduce the risk of paying more for shares in the DRP than their VWAP settles at ex-dividend.

For companies that aren't CEFs, the larger a DRP discount is, the more it is tilted toward shareholders participating at the expense of those who aren't.

But for CEFs (and REITs which are closed end too), DRPs themselves pose a much greater problem as these have Net Asset Values (NAVs) that are diluted whenever shares are issued below NAV - which is commonplace as most CEFs trade at discounts and some discounts are enormous. Added DRP discounts simply increase the unfairness. Many ASX CEFs have very low liquidity so the extent to which shares could actually be bought on-market at large discounts is limited or uncertain.

In principle, CEFs with exceptional reasons could create a DRP policy that specifies the permitted discount range for DRP share issuance to apply. For example, 0 to 10% discounts could be defensible, if periodically adding to the share count for an undersized CEF is worthwhile for all shareholders.

If CEF shares are ever trading at a premium, issuing DRPs at NAV rather than a discount to VWAP may be preferable, as though this still favours shareholders participating, it is arguable that adding shares periodically to CEFs where there is more demand than supply is legitimate.

Below is an excerpt of DRP discounts for the Wilson Asset Management funds. The DRP discounts available vary, tending to exist for the funds that typically traded at premiums. Note that the marketindex.com.au DRP data is incomplete.

And below is an excerpt from WAX's dividend announcement showing where the "DRP price calculation methodology" is disclosed:

When CEFs are at discounts, DRPs can buy the shares on-market which benefits all shareholders

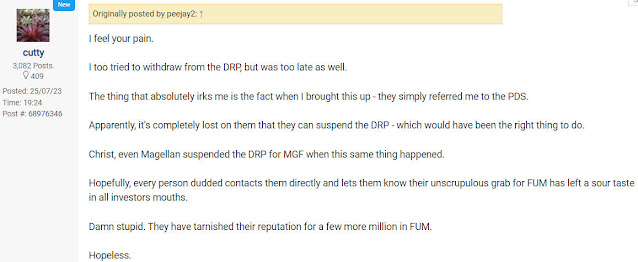

Many CEFs that typically or periodically trade at substantial discounts now have policies to suspend DRP share issuance and instead deliver the DRP by buying the required shares on-market. This is a much fairer approach. The shares get acquired at a discount and it is accretive to NAV for all holders.

For example, Wilson Asset Management does this whenever its CEFs are trading below NAV. The example below is for WAR:

3. Ophir High Conviction Fund example of unfair DRP at NAV when OPH is at a discount

DRPs are intended to be decisions shareholders make at a point in time to suit their best interests and revisit when their interests may change. Once a shareholder uses the registry to opt in to the DRP it applies indefinitely till they opt out, they are not asked to re-confirm before each dividend.

A typical shareholder electing to enter a DRP, typically does so on the basis that the DRP consequences will be similar in future periods.

This is where the pitfalls of CEF premiums and discounts come into play. Premiums and discounts can change enormously, have consequential impacts in every aspect (in this case DRPs), and leave shareholders open to being exploited.

A case in point is the Ophir High Conviction Fund (OPH).

A strong period of outperformance in 2020 took it to a premium and the first distribution issued 30 June 2021 indicated the DRP price would be NTA, thus representing an opportunitiy to obtain shares ~8.7% lower than the likely share price given OPH was trading at an 8.7% premium. No doubt this enticed many shareholders to go tick the DRP opt-in box.

However, OPH, like the majority of ASX CEFs, now trades at a discount (~11% for the most recent 6 months).

Yet, for its 30 June 2023 distribution it kept the DRP price at NAV, which now has the opposite effect: shareholders would be getting ripped off, paying ~13% more for DRP shares than the market price!

30 June 2023. OPH Unit Price: $2.42. NAV: $2.78. Discount: 13%

Given the adverse impact of remaining in the DRP, Ophir Asset Management could have at minimum linked to the DRP Plan Rules and provided further information warning shareholders they would almost certainly be paying a premium for issued shares. However, they chose not to do so.

4. List of all ASX CEFs with unfair DRPs at NAV even if the CEF is at discount

In this section, I will be compiling a list of all ASX CEFs that have DRP policies like OPH's that allow DRP shares to be issued at NAV when the share price is at a discount.

I will be emailing each CEF to send them a link to this page and asking them to announce a change in their DRP policy. I will publish the date of my email here.

I will then publish the date their DRP policy has been rectified to remove this gross unfairness.

ASX CEFs that do not revise their DRP policies will be subject to an extended name and shame campaign till they eventually do so.

1. Ophir High Conviction Fund (OPH). Emailed: 11 Aug 2023. Status: Rectified in May 2024

2. No other ASX CEFs found with unfair DRPs at NAV like OPH.

Please Contact me if you do find one.

5. Other relevant ASX CEF DRP Excerpts

a. RF1

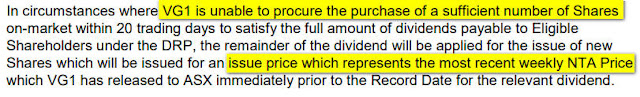

- Two scenarios: Market Price greater than NAV, DRP issues at NAV. Market Price less than NAV, aim to acquire all DRP shares on-market and only issue at NAV for any remainder.

b. VG1

- Similar to RF1 and note Regal Partners took over VGI Partners. Slightly more detail in VG1 plan regarding the price (weekly NAV) at which any DRP shares needed will be issued if they couldn't be acquired on-market.