Summary: LSF is a genuine long short fund, with very high gross exposure, considerable portfolio turnover, and it often diverges significantly from index fund performance. L1 Capital already had wholesale and retail unlisted open end funds trading at NAV and could have offered an active ETF too. However, the lure of fees on captive capital was too much and it exploited the selling commissions to raise $1.3 billion for LSF.

The choice of LIC (not LIT) structure combined with deciding not to expeditiously return tax paid as franking credits, nicely exposes one of the major pitfalls of LICs. Even during periods they are successful, there are large leakages (e.g. tax) and many LIC managers are loathe to reduce the tax leakage as it also means reducing the capital they charge fees on. The higher the fees/TER the less likely a LIC manager is to efficiently return franking credits.

|

| LSF has a large and growing tax leakage that is entirely intentional! |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. LSF Key Facts

30 June 2023 Discount:

Share Price: $2.81. Pre-tax NTA: $2.98. Discount: 6%

2. LSF Key Insight

- Firstly, the Annual Reports provide the share count to calculate values per share. At 30 June 2022 it was 611.16m

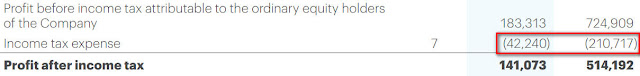

- In 2020-21, LSF made $724m and paid $210m in tax. In 2021-22 LSF made $183m and paid $42m in tax.

- So for these two years, using 611.16m shares at the end, this is ~$1.48/share in profits that would have been passed through if LSF was a Listed Investment Trust (LIT) not a Listed Investment Company (LIC).

- But LICs pay tax and for these two years the total tax bill was $253m or 41c/share. This is a very large leakage it's important to recover via franking credits. LSF was recovering tax losses so it reduced tax liabilities initially. Only actual tax paid converts to franking credit balances.

- In the Annual Report, investors can check the extent of franking credits as of Financial Year end. It does change through the year as gains/losses are made (and thus tax liabilities change). It also reduces whenever franked dividends are paid.

- As at 30 June 2022, LSF had $197m in franking credits or 32 cents/share! It's Pre-tax NTA was $2.71 and Share Price $2.56.

- Franking credits are not officially counted in Pre-tax NTA but are certainly of quantifiable value if actually returned efficiently to shareholders. It's 32c in franking credits were 12.5% of its Share Price.

- LSF plays along with the conventions of ASX LICs in padding out its "Dividend Profit Reserve" to convey its ability and inclination to pay dividends.

- However, $605.5m divided by the 611.16m share count = 99 cents/share in the reserve!

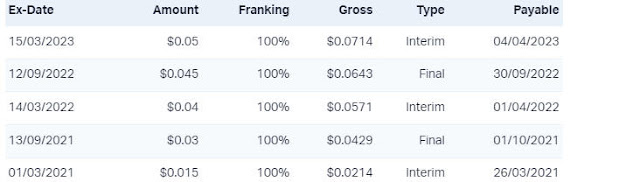

- Yet, LSF has only returned 18 cents in dividends in its entire history!

- LSF would need to pay a catch-up dividend of over 100 cents to return most of the franking credits it still has (32c at 30 June 2022 minus ~4c attached to dividends but then plus tax payable for the 2022-23 FY). Of course, this won't happen!

- While Zenith reports LSF's Dividend Policy thus:

- A closer look at its Prospectus reveals the original truth:

Delivering a high dividend is not a primary objective of the Investment Strategy or the Manager.

- This is fine in principle, but then LSF should have launched as a LIT (where tax passes through) and it can still convert to being a LIT now. The major issue is that L1 Capital is exploiting the fact it is a LIC and has full discretion over the size of dividends it pays. L1 Capital does not want to pay over a $1/share in dividends to release the over 30 cents/share in franking credits. At $1/share this would be a loss of ~$611.16m in captive capital on which to charge its enormous management and performance fees. (More on those, another time.)