Summary: Plato Income Maximiser (PL8) actively invests in Australian shares to generate a high, reliable dividend yield which is fully-franked. Plato self-describes as "a boutique fund manager specialising in maximising income for pension-phase and SMSF investors." PL8 is the only equity ASX Closed End Fund (CEF) to pay monthly dividends and trades at a ~15-20% premium to NTA. PL8 is an example of the Cash Franking Credits rort that is the primary reason most LICs still exist. In NTA terms, PL8 has underperformed VAS/STW from inception in 2017 to August 2023, and also in the last 3 and 5 years. In TSR terms, PL8 has slightly outperformed VAS since inception, thanks only to the ~20% premium. PL8's premium is irrational for several reasons. In this post, I focus on just one irrationality: Plato has an equivalent open end fund to PL8 which can be bought and sold at NAV. If PL8 investors were rational they could access the identical strategy at a ~20% discount, thus generating ~20% higher yield and franking. However, distributions would vary significantly. Below, I compare performance, yield, franking, dividend frequency and Total Expense Ratios (TER) of the two funds. Of course, the truly rational investors will focus on long-term performance (after all costs) and choose the cheapest, passive ASX200/300 index funds (A200, VAS, IOZ) with TERs as low as 0.04%!

|

| PL8 has a superior Open End fund that trades at NAV not a 20% premium! |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. PL8 Key Facts

30 June 2023:

Share Price: $1.27. Pre-tax NTA: $1.04. Premium: 22%

Note: I will be adding STW comparisons for PL8 (which benchmarks ASX200), but recommend VAS for exposure instead, as it has the top 300 not top 200 Australian companies.

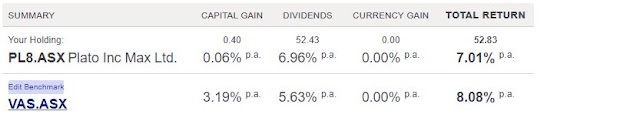

From May 2017 to 18 Aug 2023, PL8 had only slightly outperformed VAS in TSR terms, despite being at ~20% premium.

In NTA terms, PL8 has underperformed STW and VAS from 31 May 2017 to 30 June 2023:

PL8's own monthly reports , misleadingly claim 0.1% "Excess Total Return" and call out "Excess Income" of 2.2% and "Excess Franking" of 0.9% (compared to the ASX200 index):

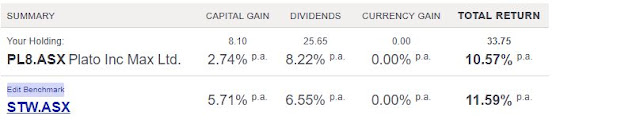

Bell Potter LIC Weekly Report as of 11 Aug 2023 clearly shows in NTA terms PL8 has underperformed its peers over 3yrs, 5yrs and since inception in 2017:

|

| Bell Potter LIC Weeky Report - 11 Aug 2023 |

2. PL8 Key Insight

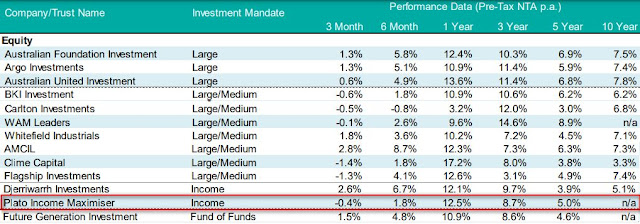

PL8 is actually based on a nearly identical, unlisted open end fund which has been running since 2011: Plato Australian Shares Income Fund.

|

| Plato Australian Shares Income Fund - Benefits |

|

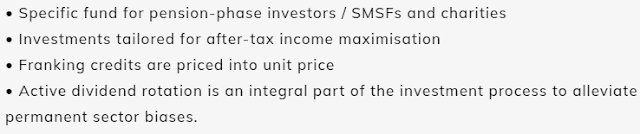

| Plato Australian Shares Income Fund - Performance |

- Quarterly distributions rather than monthly in PL8.

- Distributions vary significantly in size as everything is passed through immediately. PL8 uses "dividend smoothing" and is stable month to month, but this is inefficient as it retains a buffer. PL8's dividend occasionally steps up or down based on overall expected yields from ASX200 companies.

- Must use a platform (e.g. Netwealth, HUB24, BT Panorama) to invest or a broker's mFund service. Otherwise, a manual unlisted application is needed.

- TER is 0.9% plus 0.2% Buy/Sell spread. This compares to PL8's calculated TER of 0.9% for FY2021-22.

- The Yield over 1 year, 3 years and 5 years should be the same as for PL8. The table comparison above has inconsistent "Income" figures but the Total Returns are identical.

Why is the Plato Australian Shares Income Fund so much better than other Open End Funds at generating franking credits?

Open End Funds are pass-through vehicles for tax purposes. Hence, for most Open End versions of LICs, the franking credits are lower as they simply pass through a substantial proportion of returns as capital gains. LICs convert all realised gains (including capital gains) to taxable dividends resulting in franking credits. Global equities LICs are an excellent example of this as they have no received franking credits and a low dividend yield, but convert all realised capital gains to taxable dividends.

The Open End Plato Australian Shares Income Fund targets the highest yielding Australian stocks (including moving around to optimise dividend capture), and also maximises collection of franking credits. Thus, it has an artifically low capital gain and artifically high franked dividend yield and franking capture. It is still a pass through vehicle unlike a LIC, but is focused on franking credits.

Plato on the value of Cash Franking Credits for retirees

Plato's Don Hamson writes about the value of franking credits for retirees in: > Why Dividends Will Continue To Underpin Retirement Income In 2023

In the chart below you can see that for every one dollar of income received from fully franked dividends by pension-phase and other tax-exempt investors, an additional 43 cents on top in franking is received

Favouring companies that pay fully franked dividends, where possible, in 2023 is a no-brainer. And finally, the ability for active and nimble portfolio management to deliver greater income hasn’t changed. At Plato we don’t ascribe to the traditional set-and-forget dividend investing strategy. We believe investors must move to where the dividends are flowing. The energy and financials sectors are good examples of this. We’ve generated strong income over the past year from these sectors and remain positive on them for the year ahead. But for many years prior, they were poor performers for income investors.

Are there any good reasons to pay a premium for PL8?

In short, no, you can just buy and sell the Open End Plato Australian Shares Income Fund at NAV. As of 31 July 2023, the unlisted fund size was $2.5 billion compared to PL8's $653 million.

Conversely, buying PL8 at any premium, simply lowers the returns from those assets (capital gains, dividends and franking credits) in direct proportion to the premium paid. It's also totally irrational to pay a 20% premium for a CEF that doesn't outperform its foolproof alternative in the long run: extremely cheap passive index funds.

Over time, some PL8 investors will switch to the Open End Plato Australian Shares Income Fund. The wisest ones will switch to passive alternatives (A200, VAS, IOZ) paying as little as 0.04%! And PL8 capital will continue to be raised, given the demand. Either way, the PL8 20% premium is guaranteed to drop in the long run. And, if it goes through a period of sustained underperformance, it may even drop to a discount.

However, in the short term, PL8 has unique aspects and an appealing strategy (to current income and franking obsessed investors) in the ASX CEF space. Don Hamson summarises these in the below article.

|

| LICs need a genuine raison d’etre (Don Hamson, Plato) |

It was refreshing to find an ASX CEF fund manager that largely agrees with the key arguments of this site: Most ASX CEFs have no reason to exist in the CEF structure and no continuing source of demand; they exist and persist due to manager greed and their Total Expense Ratios (TER) reflect this; and underperformance against cheaper, passive/systematic ETFs is the main reason for discounts.

PL8's TER is 0.86% (FY 2022-23) and it charges no performance fees. The Open End Plato Australian Shares Income Fund charges 0.90% p.a. of the NAV of the Fund. The TERs of most ASX CEFs are much higher; this correlates with long-run underperformance after expenses, and thus the discounts they trade at.

Links:

> Firstlinks: LICs need a genuine raison d’etre (Don Hamson, Plato)

> Investment Centre - Plato Australian Shares Income A

> Morningstar: LICs ETFs and MFs: Four ways to invest in the same fund and save money

> Livewire - The dividend doctor gives his prescription for investing in 2023

> Livewire - The divide(nd) of income: how to invest for franking credits

> Plato Investment Management - Don’t Ignore The Franking, Ignore The Hyperbole!

> SMH - Crackdown on franking credits loophole for corporates coming

> AFR - How Vanguard patented a new way to avoid paying taxes