Summary: Regal Funds Management and Phil King have risen swiftly in recent years as a leading alternatives and hedge fund manager. The RF1 LIT is their only ASX CEF and has had impressive overall returns since June 2019, though with significant monthly volatility. RF1 is also unique with 8 distinct strategies (including water, resources and credit) that can't easily be replaced with index funds.

RF1 may well have sustained alpha in some of its strategies before expenses, but its performance fees and Total Expense Ratio (TER) are so high that, in the long run, it will be difficult for it to outperform the best passive/systematic alternative ETFs. In this post, I reveal just how eye-watering RF1's fees and expenses really are. And I also compare with the ridiculous estimates made in its original PDS.

Regal Funds Management and Phil King currently appear to be protected species (among media, commentators, analysts) due to their performance and fee-generating activity in the financial sector. But there will come a time when performance suffers and greater scrutiny finally occurs. Until then, the only place you'll find the sordid, extractive reality is this website.

No free parking! RF1's Total Expense Ratio is destined to burn investors eventuallyDetails:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. RF1 Key Facts

30 June 2023:

Unit Price: $2.66. NAV: $2.97. Discount: 10%

RF1's investment strategy is described in its Monthly Reports thus:

The investment objective of RF1 is to provide investors with exposure to a selection of alternative investment strategies with the aim of producing attractive risk-adjusted absolute returns over a period of more than five years with limited correlation to equity markets. Regal's investment philosophy is grounded in the belief that a diversified portfolio of assets, using a range of investment strategies and backed by long-term capital, is key to achieving superior riskadjusted returns over the long-term.

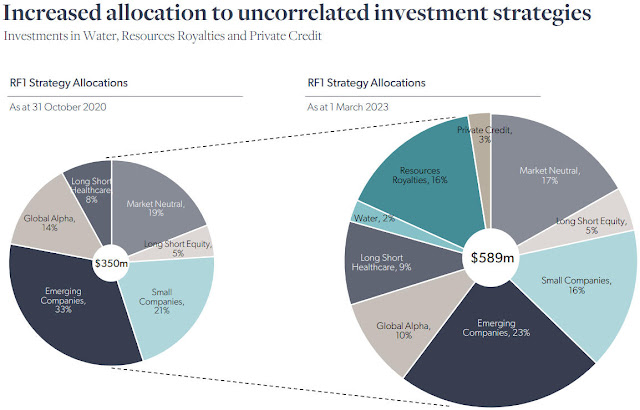

This can be seen by the allocations to 8 separate strategies that make up the RF1 portfolio.

Performance from April 2020 to Nov 2021 was exceptional and led to a significant premium developing as well. SInce then performance has levelled off. In the 12 months to 28 July 2023, NTA performance was 0%.

The expanded, underlying strategies are distinct with multiple risk factors beyond equities (royalties, credit, water rights).

Allocations to non-equity strategies have increased but correlations in drawdowns when everything is being sold off are yet to be determined.

2. RF1 Key Insight

RF1 does have a high water mark but this would only go up by the RBA cash rate and then down by at minimum the management fees but possibly other expenses too. In my view, funds should be required to publish their High Water Marks (and calculation method) in their half-year and annual reports.

RF1's management and performance fees are extractive, befitting only a manager with long-term outperformance after all expenses (this is yet to be established):

- The performance fee is 20% (plus GST) of all outperformance of only the RBA cash rate (entirely inappropriate to the beta and risk of its strategies).

- The performance fee resets every 6 months. Even with a high water mark, this should be a 12 month period as fees are subtracted from the high water mark.

- The management fee that always applies is 1.5% (plus GST) and responsible entity fee is 0.04% (plus GST). 1.54% (plus GST)

RF1 had a Total Expense Ratio of:

a. 25.6% for the Financial Year ending 30 June 2021

- This had performance fees in both half years

b. 13.5% for the Financial Year ending 30 June 2022

- This had performance fees in only one half year

In the table below, I break down the percentage of final Net Assets for each major expense category. Notably:

- Dividend expense on shorts is 1.6%

- Transaction fees are enormous at 4.2% to 6.7%

- Other expenses (dividend witholding tax, GST) are 1.5% to 2%

- Performance fees alone were 3.4% (one half year) to 12.8% (both half years)

Hopefully, RF1 investors are doing these calculations themselves, or reading this blog, as if relying on the accuracy of the PDS regulatory disclosures, they are in for a shock!

The PDS listed:

- Estimated Performance fees of 1.56% (a long way off from the reality of 3.4% to 12.8%!)

- Estimated Total costs of 3.35% (a long way off from the reality of 13.5% to 25.6%!)

- In the fine print added: "Please note that this example does not capture all the fees and costs that may apply to an individual investor, such as transaction costs." But it knew its transactional and operational costs were enormous and in the notes estimated them alone at 6.31%!

|

| This 6.31% was not included in the mandatory Cost of Fund example |

Zenith Product Assessment of RF1 Fees:

Zenith considered RF1 fees to be "highly uncompetitive in an absolute sense." It considered the performance fees to be "poorly structured" and the RBA cash rate hurdle to be "too low and not commensurate with the Trust's risk profile." Yet, it still gave RF1 a Recommended rating (2nd highest).

See: > Zenith Product Assessment: RF1 (pdf)

Links:

> Regal Funds: Regal Investment Fund

> Zenith Product Assessment: RF1 (pdf)

> AFR: Duh! How Ten Network 'cheapies' created a headache for two top traders