Summary: Geoff Wilson popularized "buying a dollar for 80 cents" regarding ASX CEF discounts, and this misleading and simplistic phrase rarely has worse consequences than when considering Thorney Technologies (TEK) where you can buy a dollar for less than 70 cents! TEK has existed since 2017 and its founder, Alex Waislitz, is a billion dollar rich lister who throws extravangant parties that apparently help shield him from criticism within the finance industry.

In this post, I explain just how wrong-headed this thinking is about CEF discounts and why TEK's discount deserves to be gigantic and, if things stay the same, only get bigger over time.

|

| TEK is apparently a “thorn in the side” of complacent managers not delivering full value to shareholders! |

Details:

The aim of these "Cheat Sheets" is to reveal why genuine expertise is needed to outperform index funds via CEFs. I reveal just one important but little known insight for each ASX CEF. (It is not the only or most important insight. I vary the insights to show how unnecessarily complex and hazardous CEF investing is). For detailed ASX CEF insights and expert services please use the Contact page to get in touch.

1. TEK Key Facts

30 June 2023 Discount:

Share Price: $0.175. Pre-tax NTA: $0.26. Discount: 33%

Thorney Technologies (TEK) "invests in technology-related investments at all phases of the investment lifecycle. TEK seeks to identify early stage companies with new and disruptive technology and business models, and invests in a broad range of areas of technology, such as fin-tech, e-commerce, education, agriculture, medical, telecommunication, robotics and AI."

As of July 2023, TEK has traded between a discount of -0.8% and -40% in the last 5 years:

Anyone reviewing a list of the most discounted ASX CEFs will find TEK near the top and might wonder: is TEK really cheap and capable of reverting to near NAV or is there something unobvious that is fundamentally wrong?

Top ASX CEF "experts" say TEK is cheap

In July 2023, Daryl Wilson of Affluence Funds Management said in a Livewire article called We're getting excited about LICs again:

The area with the biggest potentialThere are a range of mid to small LICs that invest in Australian small caps, resources and private equity. Many have our favourite combination of an attractive discount and an attractively priced portfolio. With the ASX Small Ordinaries Index still down 15-20% from the highs of 18 months ago, there's very good value in some of these portfolios.

This provides an opportunity to profit in two ways. And since improving performance very often leads to a closing of the discount, we believe buying LICs with attractively priced investments is the easiest way to achieve above-average investment results over a three- to five-year period.

Many of the LICs in this group are under-researched, unloved, or both. As one example, we've recently been buying two smaller LICs at a price below the value of their cash, meaning we're effectively getting the investment portfolio for free. We continue to research this space heavily, with the expectation that further bargains will appear over the next 6-9 months, allowing us to put our remaining cash to work.

Some of our current favourites in this group include NGE Capital (ASX: NGE), both Thorney LICs (ASX: TOP and ASX: TEK) and Bailador Technology (ASX: BTI).

In May 2022, speaking at WAM Strategic Value's (WAR) webinar Geoff Wilson said:

Geoff Wilson: We bought into Thorney Technologies when they were doing a placement at a discount, so it was a nice opportunity for us. To me, the fascinating thing is, both Thorney entities, Thorney Opportunities Fund (ASX: TOP) and Thorney Technologies, that is Alex Waislitz from the Thorney Group who manage them, are trading at big discounts. You are at approximately 25 to 30% discount, so there is exceptional value there. Thorney Technologies tend to have concentrated bets and that is why they can get some extremely good performance in both companies. In terms of how it is sitting in the portfolio, Thorney Technologies is cheap, we may as well buy some more around this discount. We just need to be clear on what their goal is and what their plans are to get them to trade at NTA if not a premium at NTA.

2. TEK Key Insight:

However, TEK isn't cheap at even a 35% discount! There is something fundamentally wrong with both Waislitz LICs: his company collects massive 20% performance fees for any gain in NAV (not outperformance of an index) in any 6 month period. Even if the NAV is way under its previous high or down overall for a financial year. There are only a couple of ASX CEFs out of 84 that have this egregious lack of a high water mark combined with no benchmark to outperform.

|

| Not only is there no high water mark but fees reset every 6 months! |

|

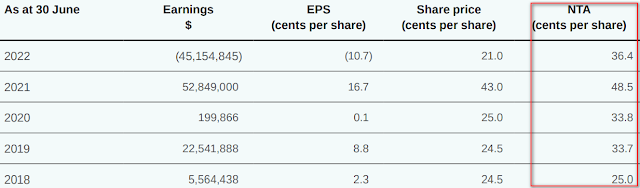

| The NTA dropped from 48.5c to 36.4c in FY2022 but $1.88m in "performance fees" were due! |

|

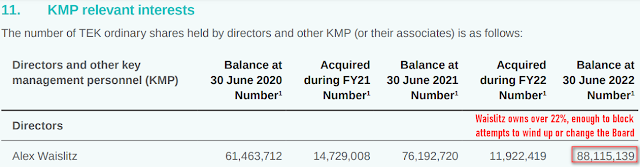

| There is no hope of activists forcing change to TEK as Waislitz has an effective blocking stake. Yet, takeover laws don't force Waislitz to buy out shareholders |

|

| In the long run, TSR exposes all outperformance fantasies! |

|

| TEK Feb 2023 Half Year results claim 11.2% performance since inception, outperforming the ASX Small Ords!? |

|

| In truth, since inception in Jan 2017, Total Shareholder Return for TEK is -4% annualised vs +8.6% for VSO |

Links: