Summary: The active management industry can talk endlessly about finding an outperforming manager because this already assumes that this is actually feasible and worthwhile. One recurring talking point is "skin in the game" - that having the fund manager significantly invested alongside other investors in its fund is positive. However, a key flaw of CEFs is that investing ideas that may have merit often provide cover for the captive capital industry to exploit.

In this post, I examine many ASX CEFs where there is ownership over 5% by the fund manager or principal fee beneficiary. In almost every case, these are blocking stakes that prevent activists targeting the CEF (typically at a big discount) for wind-up, conversion or takeover. Sadly, there isn't regulation of ASX CEFs to prevent this exploitation of the majority of shareholders.

|

| Don't worry, I'm just "aligning my interests!" |

Details:

1. Typical naive retail investors celebrate CEF fund managers increasing their stake

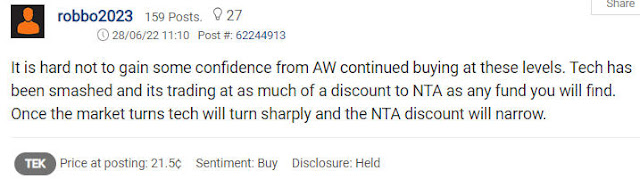

For example, whenever Alex Waislitz buys shares in his fund Thorney Technologies (TEK), shareholders usually see this added "skin in the game" as a positive sign of confidence that the CEF discount is too high:

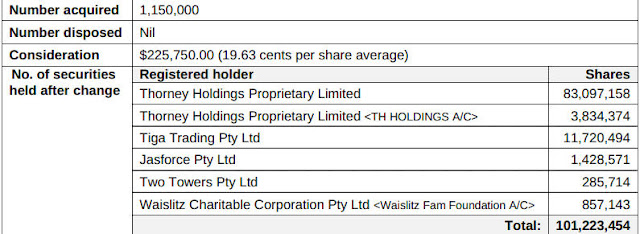

As this pattern continues and the percentage ownership becomes very significant, retail shareholders continue to put the most optimistic spin on it. For example, that billionare Waislitz might fully take TEK private, Elon Musk-style!

But is this ~$20m stake in TEK really about Waislitz wanting to better align his outcomes with retail investors, or is it about reaching a blocking stake to prevent loss of the captive capital fee machine?

2. Supposed ASX CEF experts often talk about "skin in the game" being important

The dominant media voices in the ASX CEF industry rarely mention blocking stakes in CEFs. Instead they promote "skin in the game" as a pure positive. Daryl Wilson, of Affluence Funds Management (which runs an ASX LIC fund), regularly markets Affluence's ability to offer insightful expertise. In this Livewire example on "The complete guide to LICs", Daryl Wilson states:

The other important thing for a LIC is that the manager shows respect for shareholders. And by that I mean really that they're doing the things they need to do to try to make sure that the LIC trades consistently well. So regular marketing, explaining the investment performance, what's going well, what's going poorly, where the opportunities are and aren't...

So we need to be able to understand what's happening with an LIC and how the manager's thinking — not doing anything silly with the capital structure that destroys value. And then a lot of the other features we look for in an LIC are very, very similar to the features that we would look for in an unlisted fund. So we want to see that the investment team has skin in the game and preferably in two ways: preferably by having an investment in the LIC itself, but also by owning a share of the manager so that they're doing well.

Yet, if I were writing a guide to ASX CEF investing, my first way to filter out CEFs that will never trade near NAV would be those with blocking stakes!

3. What are the Shareholding thresholds for ASX companies (inc CEFs)?

The Allens handbook on takeovers in Australia provides this summary for companies (LICs):

"The key shareholding thresholds in an ASX-listed Australian company from a Corporations Act perspective are: ≥5% (obligation to file substantial holding notice), >10% (ability to block compulsory acquisition), >20% (takeovers threshold), >25% (ability to block scheme of arrangement and special resolution), >50% (ability to pass ordinary resolution), ≥75% (ability to pass special resolution) and ≥90% (entitlement to compulsory acquisition)."

The key threshold for blocking ASX LIC wind-ups, conversions or takeovers is 25%. Given voter turnout is usually much lower than 100% and some CEFs have lots of minor shareholders who are hard to contact, blocking stakes can be effective at much lower figures. The beneficiary of the captive capital can watch for threats and fill out the rest of their blocking stake when essential.

The threshold for blocking ASX LIT wind-ups (which are managed investment schemes not companies) is more complicated. Over 50% of all potential votes is needed to pass an extraordinary resolution to wind up a LIT (which have responsible entities not boards). To block a single activist, the insider may need a stake close to 50%. But if supporters of a wind-up are numerous with smaller holdings, much lower blocking stakes can be effective. See Lanyon Asset Management and FPP for an example.

4. Which ASX CEFs have effective blocking stakes currently or may work towards them?

I keep track of all CEFs with blocking stakes. In this post, I'll focus just on the Domestic Equity category of ASX CEFs. However, there are examples in every ASX CEF category, and it is critical to know this if invested or considering trading CEF discounts.

Naturally, blocking stakes are most common among CEFs that trade at persistent, large discounts and should be wound up one way or the other.

Estimates as of 5th Aug 2023 (will be updated periodically):

TEK: Alex Waislitz (who owns the Investment Manager) controls ~25%

TOP: Alex Waislitz (who owns the Investment Manager) controls ~31%

NSC: No control over 5% by the Investment Manager

CIN: Alan Rydge controls ~61%

WAR: No control over 5% by the Investment Manager

NCC: No control over 5% by the Investment Manager

SEC: No control over 5% by the Investment Manager

CDM: Karl Siegling (who owns the Investment Manager) controls ~10%

SNC: Ron Brierley controls ~20% (MVT takeover). Geoff Wilson ~6%. Gabriel Radzyminski ~2%.

RYD: Peter Constable control ~15%. David Bottomley ~6%. Both are co-owners of the Investment Manager: Ryder Investment Management.

OPH: No control over 5% by the Investment Manager

ACQ: Australian Unity Funds Management ~8.7%. No control over 5% by the Investment Manager (Acorn Capital)

FSI: Emmanuel Pohl (Investment Manager EC Pohl & Co) controls ~39%. Gregory Burton ~5%.

FOR: No control over 5% by the Investment Manager