Summary: With invested assets over $8.5 billion, the Australian Foundation Investment Company (AFI) is the 800 pound Closed End Fund gorilla on the ASX. But not only hasn't its portfolio outperformed the cheaper ASX200 ETFs (A200, IOZ, STW) over any period greater than 5 years, but it simply can't do so. In this post, I reveal the index-hugging nature of AFI (including using options) and argue that its greater Total Expense Ratio (TER) means it is destined to underperform ASX200 ETFs with TERs as low as 0.04%. AFI often trades at ridiculous premiums to Pre-tax NTA but will inevitably drift to a permanent discount in the long run. AFI has many unobvious pitfalls too: a massive tax liability anytime it sells longstanding positions, a resulting bias to be slower to rebalance if it means realising large gains, over $115m in international stocks (for a new international LIC that never emerges), and an actual TER that is 0.22% (appreciably higher than the 0.14% figure it advertises, and five times higher than the 0.04% of the A200 ETF).

|

| Index-hugging CEFs simply can't outperform much cheaper index ETFs |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. AFI Key Facts

31 Jul 2023:

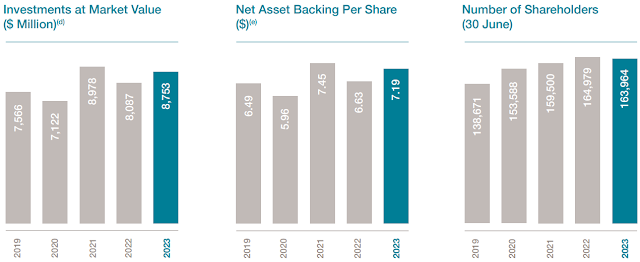

Share Price: $7.21. Pre-tax NTA: $7.36. Discount: 2%

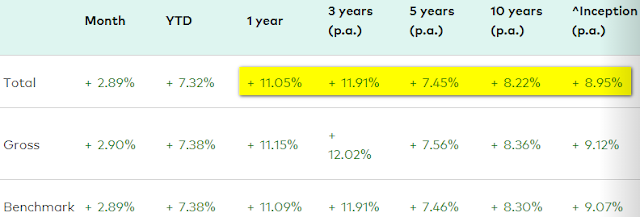

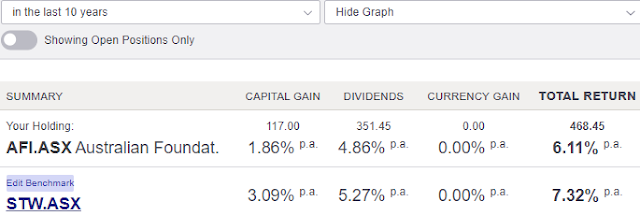

AFI often trades at a premium to NTA, yet its 10 year Total Shareholder Return (share price plus dividends plus franking credits) is lower than the STW ETF that tracks the ASX200 index:

|

| TSR Last 10yrs to 4 Sept 2023 |

Over 20 years, STW outperforms in TSR terms by 7.02% to 6.67%:

|

| TSR Last 20yrs to 31 Aug 2023 |

In NTA terms the underperformance is even more obvious. AFI's own monthly reports make this clear over all periods from 1 year to 10 years:

|

| The index (purple) has outperformed AFI's active management over 1, 3, 5 and 10yrs |

2. AFI Key Insights:

AFI claims as reasons to invest it is: reliable (1928 inception), trusted by over 160,000 investors, low-cost, diversified, and has "long term investment performance". Well those might have been good reasons up until the STW ASX200 ETF arrived in 2001. But since 100% safe, diversified, low-cost, systematic index-tracking ETFs came into being, there has been no reason for AFI (or other index-hugging CEFs) to continue. (Note: Don't use STW now it's expense ratio is 0.13%! The cheapest ETF to deliver ASX200 returns is A200 and for ASX300 returns VAS)

The dim reality within AFI is that they actually understand they can't outperform low-cost ASX200 index funds like A200. Hence, the details of their claim about "long term investment performance" are simply:

AFIC aims to provide shareholders with long-term returns and dividends that grow faster than the rate of inflation. Our goals help you achieve yours

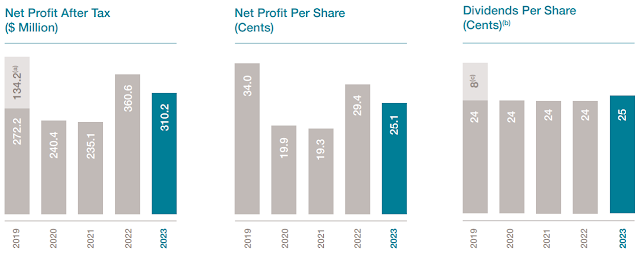

What kind of defensible raison d'être for an active equity fund is that? AFIC should just shut down if its bar is set as hoping for capital growth and praying for dividend growth above inflation! Excluding a special dividend in 2019 triggered by the franking credit reforms Labor took to an election, AFI has grown its dividend by 1 cent since 2016 (~0.1%)! See the table at the end of this post with AFI dividends since 2016.

Compare this with VAS (the Vanguard ASX300 cheap index fund). It transparently communicates that equities are high risk, the minimum investment timeframe is 7 years, but that you get systematic, hassle-free, fully-diversified exposure to the returns of the top 300 market cap companies on the ASX.

VAS is able to provide a fully-transparent view of costs, holdings and performance. These pure index returns from truly low-cost passive ETFs are very attractive: 8.22% per annum over 10 years and 8.95% per annum since May 2009:

Why AFI doesn't just shut down if A200 or VAS are far superior ways of investing in the ASX200 or ASX300?

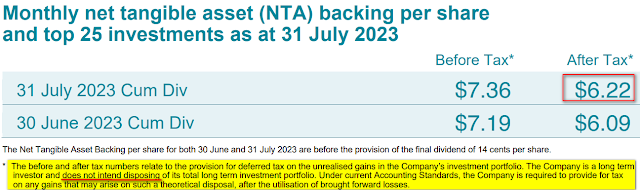

Well obviously there's the self-interest of the managers and Directors in keeping their pay packets. However, there is another issue hiding in plain sight: AFI (and other "grandfather LICs" like ARG, WHF, AUI, DUI) are using a tax-inefficient LIC company structure that requires tax to be paid by the LIC, rather than any tax consequences simply passed through to investors. Realising gains thus creates tax leakage that can only be returned via franking credits but is never efficient. These LICs could have switched to a trust structure (LIT, active ETF, unlisted trust) or just wound up. But as they've kept going, large gaps between their Before Tax (on unrealised gains) and After Tax NTAs have emerged:

|

| New investors in AFI are picking up the risk inherent in this NTA gap between Before and After unrealised tax |

|

| The tax liability on unrealised capital gains was $1.36 Billion on 30 June 2023 |

The Company is a long term investor and does not intend disposing of its total long term investment portfolio

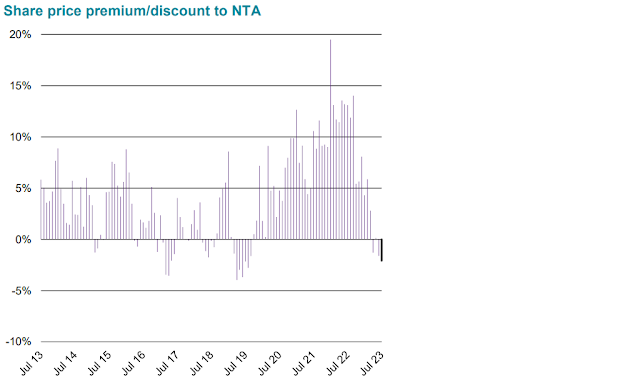

In 2021, AFI got to a record premium to NTA of 20% as naive investors chased the Covid recovery stock market boom following advice from apparent investing savants like Scott Pape, Peter Thornhill and their acolytes:

The warning for AFI investors who bought at premiums or didn't get out at premiums is that time is now over.

> Scott Pape has changed his tune on AFI. He finally saw the writing on the wall.

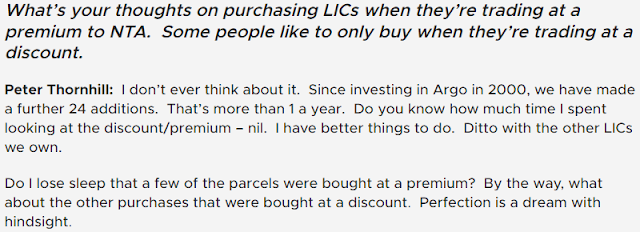

> Well-known defenders (e.g. Peter Thornhill) of these redundant, index-hugging underperformers no longer publicly defend their "who cares about premiums and discounts" rhetoric but happily continue to sell their investing seminars.

|

| Peter Thornhill has consistently advised not to worry about buying AFI, ARG, etc at premiums |

In FY 2022-23, AFI investors got taught a painful lesson as they underperformed the ASX200 by 18% over the year as the 20% premium evaporated!

Not to worry. AFI's managers apparently have a sophisticated understanding of Closed End Funds and reassure us that the reason for the drop in the premium was rising interest rates:

There appears to have been less demand for equity funds across the industry as interest rates have risen over the year and AFIC was not immune from this trend.

Yet, there are net retail inflows to AFI's direct ETF competitors (A200, IOZ, VAS) every year, regardless of interest rates, as individuals realise the cheapest, passive exposure to an equity index is superior to trying to win the loser's game.

How much of an index-hugger is AFI?

In FY2022-23, AFI charged almost $18m in administration expenses. Sadly, it never finds time to publish one of the most obvious pieces of data an investor might want to know: what is the difference in portfolios between AFI and the ASX200 index it compares itself to?

The "Approach to Investing" section of its annual report (page 5) provides the most explanation you will find for portfolio differences:

As a long term, tax aware investor we seek to be in companies that have a long term sustainable business model, with low risk of disruption. This helps to ensure portfolio turnover remains low

We prefer companies with more stable income flows. We are wary of companies that have large, inconsistent profit streams

The current carbon intensity of AFIC’s portfolio is considerably less than the S&P/ASX 200 Index

Below, I've compiled a portfolio comparison using the top 27 ASX200 stocks (taken from STW holdings) versus their AFI weights. AFI is appreciably underweight the red highlighted ones and overweight the green highlighted ones. However, overall, its clear that its portfolio is designed to be very similar to the ASX200.

|

Furthermore, I suspect AFI pretends to be less of an index-hugger than it really is by using options to offset active weighting differences. For example, in all of the highlighted stocks below, AFI appears to take an active position to be over or underweight the index but actually has options exposure against these positions that very likely offsets this active stance.

While AFI appears to boast of some differentiation strategy from the index favouring quality and stable profits, it also has a tilt to "long term business models" and lower carbon intensity. I'm confident the investment managers at AFI understand that they can't beat the market and that their TER is now too elevated above A200, IOZ and VAS to outperform.

|

| AFI annual report transparency is way better than most. Investors should study this excerpt closely! |

|

| NTA goes down whenever Net Profits can't cover maintaining the dividend |

|

| 2014-2018 reveals the same story |

|

| Over 2014-2018 the Dividend maintenance and NTA impact is the same |

|

| AFI promises dividend growth above the inflation rate but doesn't deliver it. (Marketindex) |

Links:

> AFR - Bargain-hunting opportunities for the brave

> AFIC - What it means to trade at a discount or premium to NTA