Summary: Argo Global Listed Infrastructure (ALI) is a $376m LIC managed by Argo Investments, best known for its $6.5b ARG LIC. Since 2015, its generally traded at narrow discounts to NTA and is presumably seen as a stable fully-franked income payer by its investors. However, as I warn universally on this blog, the salad days for Closed End Fund (CEF) ASX investors are over. If you want to invest in global infrastructure there are numerous cheaper, transparent ETFs providing systematic exposure (and exits!) at NAV. Meanwhile, ALI investors are treated like mushrooms, with portfolio disclosures 3 months out of date and no enlightenment about the true risks of a portfolio so linked to rates and inflation. Prolonged NTA drawdowns (and typically underperformance of ETFs due to higher expenses and inefficiencies) eventually hit all CEFs. But the next hit is now terminal for all ASX CEFs as they will spiral into growing discounts. ALI's death spiral has now started.

|

| Unlike ETFs, there's no exit ramp at NAV for CEFs as they spiral into underperformance |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. ALI Key Facts

31 Aug 2023:

Share Price: $2.18. Pre-tax NTA: $2.3. Discount: 5%

|

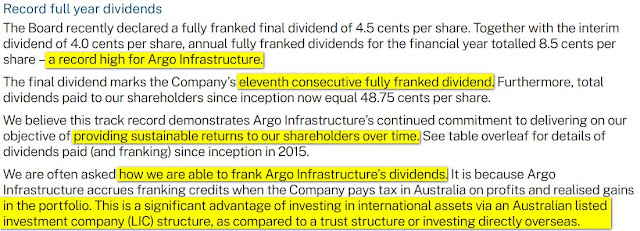

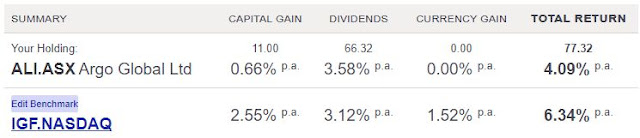

| ALI has delivered a TSR (including franking) of only 4.09% from July 2015 to 3 Oct 2023, underperforming cheaper ETFs like IGF |

|

| Of course, you could just pay 0.18% for a cheap global index fund like VGS and make 9.1% |

|

| ALI's diversification is illusory if all stocks are designed to be bond proxies! |

2. ALI Key Insight:

In ETFs, all holdings are disclosed with their portfolio weight, they are typically updated daily, and usually can be exported into a spreadsheet. For example, iShares Global Infrastructure ETF (IGF) discloses all ~114 holdings updated daily:

Conversely, ALI does not disclose even a top 10 stocks in its monthly NTA reports and now only provides quarterly disclosures of top 10 holdings. As of 3 Oct 2023, the most recent information on holdings is as of 30 June 2023!

Sadly, this isn't some secret Argo or its outsourced manager - Cohen and Steers - discovered. Stock markets price in all advantages and tradeoffs / disadvantages (of which Argo was silent about on this web page). Supposed diversification into infrastructure was simply a popular bandwagon a few years ago that Argo jumped onboard. It's a pity Argo hasn't subsequently sought to provide a balanced perspective on the macro drivers of the price of these stocks. It's Insights section is always resolutely positive.

So let's plug in these stable, predictable, inflation-linked top 10 ALI stocks into an Investing.com portfolio price tracker and see how they are going as of 3 Oct 2023:

|

| A sea of red is washing through ALI's defensive portfolio as the U.S. 10yr yield breaks out |

ALI's reports continue to describe this drawdown as infrastructure stocks simply being "out of favour" and defensive stocks being "overlooked" currently in favour of growth stocks.

Indeed it's recent Shareholder Letter published 29 Sept 2023 urges investors to look past the "accounting standards" that are reducing the NTA as what really matters is the income generated by the portfolio!

Don't worry about the plummeting NTA, ALI has just reached a record fully-franked dividend of 8.5c!

It's actually obscene that Argo is allowed to assert that a significant advantage of the LIC structure is the ability to pay fully-franked dividends. The truth is that paying tax is a massive inefficiency and leakage in LICs and makes them totally redundant compared to LITs and ETFs.

All of the pitfalls, leakages and higher Total Expense Ratios (ALI's is 1.6%) are finally catching up to ASX Closed End Funds as time inevitably delivers growing underperformance. In this case, the $376m ALI is finally going to be exposed as the naked little emperor it's always been.

Update: 23 Oct 2023. ALI starts the reality check

Given the 2023 NTA slide and even bigger share price spiral, in its AGM presentation, ALI has started to get to grips with the reality that simply maintaining a franked dividend level isn't the goal of investing.

The presentation provided alarming Total Return comparisons (NTA and Share Price) like the one below:

Regardless of this apathy about Total Shareholder Return, a big shakeout in these ASX "Income LICs" is coming. ALI is not immune; it's in the midst of major underperformance. This has started its discount spiral, and ALI holders who don't care about share prices are going to have this nonchalance sorely tested!

See: > Staying ahead of the retiree Income LIC shakeout

There are over 177 million ALI shares that will eventually need to find new owners. The 2023 AGM presentation includes a photo of ALI investors and reveals the long-term challenge for a Closed End Fund. Where is the next generation of ALI holders coming from if its underperformance persists?

|

| Even income-focused future Australian retirees will migrate to the best options. Will ALI be among them? If not, what happens to its discount? |