Summary: PM Capital Global Opportunities Fund (PGF) is Paul Moore's global equities LIC that listed in Dec 2013. PGF has slightly exceeded VT (Vanguard Total World Stock ETF) since inception with a TSR of 10.3%. However, in the 5yrs to 30 Sept 2023, PGF has handily outperformed VGS over any period from 1 to 5yrs in NTA and TSR terms. This is very rare for an ASX CEF, and PGF has moved from ~20% discounts to now trading at ~5% premiums to NTA. But is paying a premium for PGF justified? Does PGF have sustainable outperformance alpha after all expenses? How much of a factor does the presumed stability of PGF's 7.7% (inc franking credits) yield play? A full assessment of PGF as an investment going forward would need to cover the Total Expense Ratio, fairness of performance fees, ethics of the manager (e.g. no dilutionary capital raisings), tax leakage, and efficiency of return of franking credits. I'll simply state these aren't major pitfalls for PGF, but I note the tax leakage issue below. It would also need to address the alpha question, which I do briefly with performance comparisons. However, in keeping with the aim of these "cheat sheets" I am going to focus on one distinct aspect: recency bias and how this especially affects CEFs.

|

| Performance chasing and recency bias almost never ends well, especially for CEFs |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

Note: Low-cost global share ETFs used depend on inception dates.

VT: Vanguard Total World Stock ETF. U.S. Listed. Inception 24 Jun 2008. TER: 0.07%

VGS: Vanguard MSCI Index International Shares ETF. ASX Listed. Inception 18 Nov 2014. TER: 0.18%

1. PGF Key Facts

31 Aug 2023:

Share Price: $1.89. Pre-tax NTA: $1.85. Premium: 2%

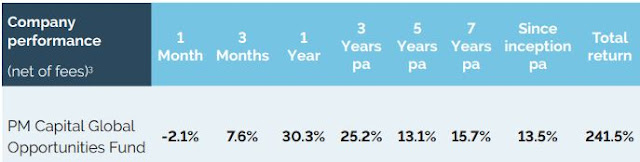

Since inception (31 Dec 2013 to 6 Oct 2023), PGF has a Total Shareholder Return (TSR) of 10.31% slightly outperforming VT (Vanguard Total World Stock Market) at 9.89% (Note PGF is aided by a shift from a slight discount to a slight premium).

|

| PGF 5yr TSR to 6 Oct 2023 has outperformed |

|

| PGF 2yr TSR has massively outperformed |

|

| PGF 1yr TSR has significantly outperformed |

PGF Pre-tax NTA returns to 31 Aug 2023, have outperformed ASX CEF peers significantly:

|

| Bell Potter Pre-tax NTA performance to 31 Aug 2023 |

However, PGF's Pre-tax NTA return from inception (31 Dec 2013) to 31 Aug 2023 has essentially been the same as VT:

|

| PGF Monthly report Aug 2023 |

PM Capital also loves boasting about (including in each PGF Monthly Report) the unlisted strategy's cumulative performance since 1998. It's impossible to verify this, but the relevance to PGF is questionable. PGF has been listed since 2013 and that's plenty of time to simply report its performance going forward.

|

| PGF Monthly report August 2023 |

2. PGF Key Insight

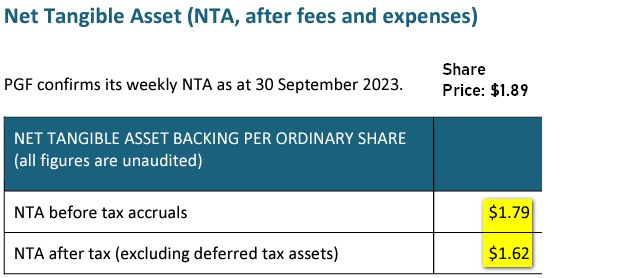

At 30 Sept 2017: PGF's Share Price was $1.10 and Pre-tax NTA: $1.2425. Discount: 11.5%

At 30 Sept 2018: PGF's Share Price was $1.295 and Pre-tax NTA: $1.361. Discount: 5%

At 30 Sept 2019: PGF's Share Price was $1.07 and Pre-tax NTA: $1.3062. Discount: 18%

At 30 Sept 2020: PGF's Share Price was $0.98 and Pre-tax NTA: $1.163. Discount: 16%

At 30 Sept 2021: PGF's Share Price was $1.49 and Pre-tax NTA: $1.6565. Discount: 10%

At 30 Sept 2022: PGF's Share Price was $1.465 and Pre-tax NTA: $1.4533. Premium: 1%

At 30 Sept 2023: PGF's Share Price was $1.89 and Pre-tax NTA: $1.79. Premium: 5.6%

Until the last couple of years, PGF has traded at significant discounts. Recency bias is a real thing, as active management outperformance (after all expenses) takes over 10 years to distinguish between skill and natural distributions in returns.

Bell Potter reports that in the last 5yrs to 31 Aug 2023, PGF's discount has been as high as 22% and averaged 9.5%. It's maximum premium is 6.2% which was the current premium at 31 Aug 2023.

Interestingly, I started trading PGF on 27 Oct 2017 and last traded it on 1 April 2022 when the discount became too narrow (in my view) to provide an acceptable margin of safety. In retrospect, I was wrong and sold too early, as the narrow discount became a persistent premium!

According to Sharesight, I made a CAGR of 40.3% trading PGF over this period compared to 10.7% from VGS:

PM Capital Asian Opportunities Fund (PAF) - A cautionary tale

From its launch in May 2014 to Dec 2017, PM Capital also highlighted the returns of the sister fund to PGF: PM Capital Asian Opportunities Fund (PAF).

Indeed, for a brief time, PAF also traded at a premium to NTA. The performance chasing was interesting to watch.

Unfortunately, from inception in May 2014 to 31 Aug 2021 (just before PM Capital proposed to delist it via merger with PGF) PAF severely underperformed its low cost ETF alternative (Vanguard FTSE Developed Asia Pacific ex Japan ETF) with a 3.55% Total Shareholder Return versus 8.3%. (VDPX is used not VAE as VAE didn't commence till Dec 2015):

PAF traded at discounts of ~15-22% in the period before the proposals to merge and delist it. Survivorship bias is a pervasive issue among actively managed funds and the ASX CEF space is no different. Dozens of failed, underperforming CEFs have gone to the grave and their fund managers have deleted all information about their typically abysmal performance.

This isn't sour grapes on my part. PM Capital is definitely one of the fairer and more trustworthy ASX CEF managers. Paul Moore didn't have to open the door to an exit near NAV for PAF holders in 2021, though PAF's underperformance was embarrassing. I simply provide these facts to show that the same manager can have vastly different long-term performance outcomes for separate funds. All active fund managers bury the failures and only highlight the successes.

Indeed, I traded PAF dozens of times between Oct 2017 and sold out in Dec 2021 just prior to the WAM takeover. Sharesight reports I had significant outperformance during this period but the vast majority is due to predicting the wind-up of PAF (I was the 6th largest shareholder when the wind-up was announced). However, the key point is that this is a zero sum game and my gains were at the expense of other shareholders.

Frankly, it's annoying that I haven't been able to trade PGF since April 2022 due to it not trading at enough of a discount. However, this wasn't all standard performance chasing and recency bias. ASX LICs suffer from an irrational obsession by retail investors with the stability of high, fully-franked dividends. Even though Cash Franking Credits aren't actually an advantage compared to simply having LITs/ETFs pass through the tax consequences, the lure of imaginary "free money" is great.

On 31 Jan 2022, PGF had a share price of $1.55 and Pre-tax NTA of $1.768. Hence, a discount of 12.3%.

On 11 Feb 2022, PGF published its Half-year report and a special announcement on dividend guidance and since then the discount has inexorably closed up:

At least 5 years of fully-franked dividends with a grossed up yield of ~7-9% is just too alluring for ASX retail investors interested in LICs and LITs (or the financial advisors advising them). A lot of new PGF holders also seem to have switched from all the underperforming ASX global equity CEFs. PGF's performance figures now appear to be secondary to its franked dividend reliability. For as long as this dividend level and predictability is maintained, I expect PGF to trade at only narrow discounts and often trade at premiums.

The exception could be sharp NTA drawdowns. PM Capital doesn't really engage in market timing or major de-risking and there will be periods when PGF's NTA simply follows the market.

PM Capital is also a value-focused manager and there will be periods when value underperforms. Recency bias will no doubt kick in again by way of the premiums and discounts that PGF trades at.

Understanding PGF's NTA figures and tax leakage

One thing buyers at premiums to NTA should note is how to properly understand PGF NTA announcements. The 30 Sept 2023 Pre-tax NTA was $1.79 but Post-tax is $1.62. This simply indicates the coming tax leakage of a LIC. PGF's Pre-tax NTA will eventually drop ~17c and those 17c in tax paid will become franking credits to be returned only via future franked dividends.

While PGF is a reliable returner of tax via franked dividends, large gaps between Pre-tax and Post-tax NTAs are worth factoring into the discount/premium one pays for a portfolio of assets. After all, once these gains are eventually realised, the size of the portfolio of companies that exist to make profits and deliver returns is going to fall by this gap. I wouldn't pay $1.89 for a portfolio that could be worth much less than $1.79. However, PGF's discount/premium is not in the hands of investors like me!

PGF has an unlisted, nearly identical Open End version that always trades at NAV

See: PM Capital Global Companies Fund- It has not paid a distribution since 2011 which requires more investigation as to how an unlisted "pass through" fund is not distributing realised profits.

Performance figures for the unlisted Open End PM Capital Global Companies Fund:

|

| TSR from 2 Nov 1998 to 6 Oct 2023 (SPY ETF used as no All World ETF existed in 1998) |

|

| TSR for 5yrs to 6 Oct 2023 (PGF was 12.85%) |

|

| TSR for 2yrs to 6 Oct 2023 (PGF was 20.7% which included significant discount compression) |

|

| TSR for 1yr to 6 Oct 2023 (PGF was 27.7%) |