Summary: Hearts and Minds Investments (HM1) is a LIC with the "highest conviction equities from leading Australian fund managers, with all fees donated to medical research institutes". A third of the portfolio is dedicated to picks from the annual Sohn conference for 12 months. Swinging for the fences rode the boom in 2020-21, but also a huge bust afterwards. HM1 now persistently trades at ~15-20% discounts and often pops up on the radar of investors targeting ASX CEFs. In this post, I reveal how, in LICs, tax leakage, franking credit balances, and dividend policies can significantly affect the NTA and investor outcomes. Franking credit balances are not counted in published NTA in LICs, and HM1 indicates the complexity and expertise involved in assessing true discounts, and whether they are likely to revert before the holding costs (plus any underperformance) outweigh any gains.

|

| Who benefits from the smoke and confusion in the LIC wastelands? |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. HM1 Key Facts

30 June 2023:

Share Price: $2.26. Pre-tax NTA: $2.9. Discount: 22%

On the face of it, this discount level might seem attractive given that HM1 has traded at a premium when its portfolio (tilted toward tech and growth) is doing well.

In 2020-21, HM1 reported a 28% pre-tax investment return and stated "Since the inception of the Company in November 2018, HM1 has generated a compound annual pre-tax investment return of 28.1% compared to the MSCI World Net Total Return (AUD) Index increase of 16.6% per annum over the same period."

The gains were so large in this period ($189m realised, $49m unrealised), the Tax Expense took $66.4m or 29c out of NTA:

Just a year later in 2021-22, it had all gone south. with a decline of 33% in pre-tax investment return. This time Realised gains were $39m but Unrealised losses were $340m so the Tax Benefit was +$95m.

2. HM1 Key Insight

LITs are pass through for tax purposes and don't pay tax. LICs do pay tax, and due to Cash Franking Credits being their only reason to exist today, are perversely incentivised to maximise tax paid and franking credits to distribute.

For the prior two financial years, I have summarised below some of HM1's key tax and franking credit details. I am not going to explain here the complexities of the impact of tax paid, franking credits and tax losses on the Adjusted NTA estimates I provide.

Suffice to say, there is often enormous tax leakage in LICs, and whether, how much, and when this is returned as franking credits is up to the fund manager and Directors.

In a separate post I use LSF to show that many LIC managers are loathe to reduce the tax leakage as it also means reducing the capital they charge fees on. See: > LSF - L1 Long Short Fund - Cheat Sheet

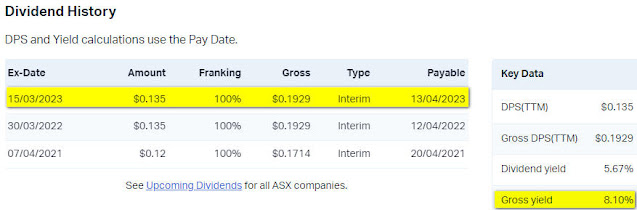

However, in my view, HM1 is aiming to return all of this tax leakage via franking credits, and the sheer scale of its franking credits balance implies a stable or growing fully-franked dividend till the franking credit balance is lower (e.g. a few years of dividends).

Large LIC franking credit balances are also a key attraction for activists, as they typically aren't factored into the discount to NTA and can be released more speedily in a conversion or takeover.

30 June 2021:

Shares: 226,034

30 June 2021 NTA figures: Pre-tax: $4.33 Post Realised Tax: $4.20 Post-tax (realised and unrealised): $3.92

Annual Report Net Assets: $885,999m ($3.92)

AR Tax Liabilities (reducing Net Assets): $29.3m Current tax + $65.3m Deferred tax (-41.8c)

FY Net Tax Expense: $66.4m (see graph)

Franking Credits available for use: $72.66m (32c). (Not counted in NTA)

Adjusted NTA: $4.2 + (Present Value of 32c of franking credits)

30 June 2022:

Shares: 227,851

30 June 2022 NTA figures: Pre:tax: $2.58 Post-tax: $2.81

Annual Report Net Assets: $641,130m ($2.81)

AR Tax Assets (adding to Net Assets): $14.8m Current tax + $38.1m Deferred tax (+23c)

FY Net Tax Benefit: +$95m (see graph)

Franking Credits available for use: $81.87m (36c). (Not counted in NTA)

Adjusted NTA: $2.58 + (Present Value of 36c of franking credits) + (Present Value of 23c in tax losses)

Do LICs always publish accurate information on NTA and Franking Credits?

Absolutely not.

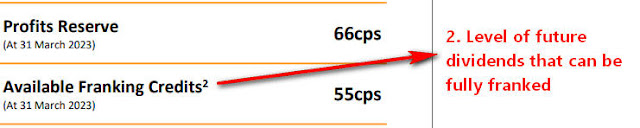

For example, in Oct 2022, HM1 started publishing a "Franking Balance" which it reported as 69 cents per share! Even if one were to discount the present value by 50% this would supposedly add 34.5c to HM1's Adjusted NTA! Pre-tax NTA of $2.77 would be $3.11 compared to a Share Price of $2.37!

However, this figure was inaccurate and misleading. I emailed HM1 and eventually got them to include a note clarifying that this represents the "level of future dividends that can be fully franked" with its current franking credits balance.

Do you fancy yourself as a LIC tax expert?

If so, you'll have lots of time-consuming adventures in LIC land getting to grips with the many complexities. And, remember, these 30 June balances change all the time as realised and unrealised gains change, tax is paid, tax is refunded, dividends are paid and franked, tax losses are used up or added to, etc. Accurate changes affecting franking are never consistently disclosed in Monthly Reports.

If not, consider who is benefiting from all of this unnecessary complexity, inefficiency and discretion. It isn't investors. Now go read the About page and focus on passive alternatives to Closed End Funds (CEFs).