Summary: In June 2021, Wilson Asset Management raised $225m for its 8th LIC: WAM Strategic Value (WAR). Its strategy being to capitalise on discounts to net asset value, primarily in LICs and LITs. If the ASX Closed End Fund (CEF) sector has plenty of worthwhile investments, and if there is an efficient way to close discounts, then why not invest alongside the LIC king Geoff Wilson?

Especially as Wilson Asset Management funds (e.g. WAM, WLE) have been behind most of the takeovers and activism in the ASX CEF sector. And, unlike retail investors, their funds can get to 5% holdings to call shareholder meetings to consider exits near NTA (takeovers or conversions). Thus, even if not buying WAR directly, investors in ASX CEFs may be very interested in WAR's chosen investments - these would obviously be the best short to medium-term opportunities in the entire ASX CEF sector according to Wilson Asset Management.

Well the above is the theory. In this post, I share the disenchanting reality about CEF discount capture strategies and WAR's actual ability to exploit them. I reveal the facts about WAR's NTA and Total Shareholder Return performance since inception. And I take a deep dive into WAR's current portfolio and provide analysis and commentary on the LICs and LITs it holds and their prospects.

|

| Still waiting to see Wilson Asset Management go to WAR against underperforming LICs |

Details:

The aim of these "Cheat Sheets" is to reveal how difficult it is, even with genuine expertise, to outperform cheap index funds with CEFs in the long run. I reveal just one important but little known insight for each ASX CEF. It is not the only insight; nor always the most important one. I vary the insights to show how unnecessarily complex and hazardous CEF investing is. For detailed ASX CEF insights and expert services please use the Contact page.

1. WAR Key Facts

30 Sep 2023:

Share Price: $1.035. Pre-tax NTA: $1.186. Post-tax NTA: $1.223 Discount: 13%

In Total Shareholder Return (TSR), since inception (30 Jun 2021 to 20 Oct 2023), WAR has badly underperformed VDHG (diversified index fund ~90% in Australian and Gobal shares and ~10% in fixed interest) delivering -5.52% annualised versus 1.65% annualised.

This is with the discount currently at ~13%. WAR has traded at discounts up to ~18%.

In NTA terms, WAR's underperformance over this period isn't as bad against VDHG as the discount is ignored. But its portfolio was almost all equities but had a negative return, while equity index funds were positive: VAS delivered 3.11% annualised, VGS 6.7% annualised and DHHF (only diversified equities) 3.74% annualised.

Based on the above, one certainly can't claim WAR's discount capture strategy has been successful so far.

2. WAR Key Insights

Discount Capture Fantasy versus Reality

Below are some hard truths about CEF discount capture fantasies (as exemplified in WAR's Prospectus and marketing) versus the reality, as Wilson Asset Management is discovering with WAR in practice.

(a) Market mispricing opportunities?

Most of the genuine market mispricing opportunities in ASX CEFs occur via some edge tracking NTA in between disclosure periods (which can be a month apart). However, there isn't enough liquidity at worthwhile prices to make this trading feasible for WAR.

Virtually all discounts among ASX LICs and LITs are actually well-deserved and most, in my view, should be bigger and will get bigger. E.g. WAR bought TEK at a discount over 30% and Geoff Wilson commented on how cheap it was. It's now at a discount over 43%! Absent any change, TEK's discount could exceed 50%. See my post on TEK below; the cat is out of the bag, there are no buyers, and there is no exit given Waislitz's blocking stake.

See: > TEK - Thorney Technologies - Cheat Sheet

(b) Fund engagement with boards, the fund manager and other investors?

WAR inherited a $24.8m stake in PIA (from other Wilson Asset Management funds) at listing in June 2021. Despite PIA's incredible long-term underperformance and discounts that are often ~20%, Wilson Asset Management has achieved nothing so far with PIA's board, fund manager or other investors to provide an exit near NTA or radically improve performance.

(c) Catalysts for discount closure?

Paraphrasing the WAR prospectus, it says:

<<

Wilson Asset Management will, in most cases, only invest in an opportunity identified by its market-driven investment process if it can identify a catalyst (event or information) that, in the Investment Manager’s view, is likely to change the market’s valuation (i.e. the trading price) of that security.

Catalysts can be passive or pre-existing, such as corporate actions initiated by the entity or third parties (such as sales, capital raises and takeovers) or information that, in the Investment Manager’s view, has not yet been factored into the value of that security (such as earnings surprises, management changes, acquisitions or strategy updates).

In other circumstances, the Investment Manager will act as the Catalyst, through meaningful engagement with boards, management teams or where necessary, through activism, including board changes and takeover bids.

>>

The reality is very different. Out of the 30 ASX CEFs with the greatest discounts, the vast majority suffer from entrenchment: the fee beneficiary or founder has a blocking stake preventing a 75% vote to exit the CEF near NTA.

Indeed, WAR has current stakes in LICs like CIN, SB2, NGE, TEK, TOP, RYD where there is no hope of an exit near NTA unless the fund manager or founder has a radical epiphany that their fund should suddenly serve the majority of investors not themselves. As of June 2023, WAR had 17 CEF positions under 1% in size, including the ones noted above. Most of them existed with roughly the same trivial ~0.1-0.7% position in June 2022. It's hard not to conclude such positions are tokens whose primary purpose is to appear in the Top 20 in monthly reports, and make it look like WAR is much more active than it actually is.

There are few genuine catalysts that occur among ASX CEFs that provide worthwhile opportunities for a fund of WAR's size to make a sufficient gain (that moves the needle on returns) without an overwhelming underperformance penalty as I've documented with VG1.

Indeed, its prospectus examples of "earnings surprises, management changes, acquisitions or strategy updates" indicate how lazy it was in launching WAR. Did it cut and paste that from a vanilla equity fund prospectus?! These catalysts Wilson Asset Management called out offer no value for a discount closure strategy among ASX CEFs.

(d) "In other circumstances, WAR will act as the Catalyst, where necessary, through activism, including board changes and takeover bids"?

This assertion of activism, using the stick on CEF boards and managers, and organising takeover bids, was made clear in the prospectus and WAR marketing. However, it has been noticeably absent.

I expect that Wilson Asset Management imagined WAR would trade at a premium to NTA (it was oversubscribed at listing) and this would allow WAR to selectively offer scrip-for-scrip takeover bids for smaller LICs and LITs (after it had built at least a 5% stake).

But there is nothing magic about Wilson Asset Management LICs that means WAR is more likely to trade at a premium. Their LICs that trade at premiums (WAM, WAX, WMI, WLE) invest in what's considered by its investor base to be a relatively safer ASX market, with much higher yields than overseas, and the lure of "free" Cash Franking Credits. The premiums are all about the reliability of high, fully-franked dividends. I discuss this in detail here: > Staying ahead of the retiree Income LIC shakeout

In contrast, WAR's strategy forces it to wait for the limited CEF opportunities it can take advantage of, and these are often in the global CEFs (low yields and no franking to pass on). Hence, WAR has held a high cash balance (averaging over 30%). WAR hasn't been around long enough to build up artificial profit reserves and it hasn't generated enough profits to fully-frank a higher dividend yield. Under its current strategy, absent any radical outperformance miracles, I expect WAR to trade at perpetual discounts, and they could get quite large.

(e) Are all ASX CEFs fair game for discount reversion action and pressure?

There are a few ASX CEFs that have the combination of deep discounts and size / liquidity where closing the discount could actually provide worthwhile returns to WAR. These include: WGB, WMA, FGG, FGX and HM1.

However, Wilson Asset Management wouldn't dream of voluntarily winding up one of its own funds to let investors escape a deep discount that's lasted years. Wilson Asset Management also has a policy not to target funds it helped set up: FGX, FGG and HM1, even though they trade at discounts of 13-22%. In this case, the reason is reputation: FGX, FGG and HM1 donate the management expenses they would normally pay to charity. Geoff Wilson is on the boards and would be opposed to them being wound up or taken over (he's said so: WAM Strategic Value Q&A Webinar 2023 video)

That's all disclosed. What's not disclosed is whether WAR or Wilson Asset Management would ever go after fund manager friends? Geoff Wilson has mentioned he and Alex Waislitz are friends, and he has never gone after TEK and TOP despite them being standout candidates to target or just put pressure on by giving quotes to the financial media on their shockingly unfair fee structures.

So is having Geoff Wilson run WAR a pro or a con? He has a lot of friends in the Australian financial services industry!

(f) Dozens of ASX CEF opportunities?

There are certainly dozens of ASX CEFs at discounts; more than 80 out of 90 trade at persistent discounts. But there are few opportunities for WAR's current strategy with all of its present limitations: feasibility of building trading positions, placing some CEFs off-limits, and not currently having the skills or focus to analyse the few CEFs worth investing in at deep enough discounts.

In the WAR prospectus, it says:

The Company will invest only when the Investment Manager can identify appropriate investment opportunities and the Company will hold cash when opportunities are not identified by the Investment Manager. There is no limitation to the level of cash which can be held in the Portfolio.

WAR's cash weighting as of 30 Sept 2023 is 16.5%. WAR's cash weighting has averaged over 30% since inception in June 2021. This simply indicates the dearth of opportunities WAR is prepared to go after.

As just one example, while WAR was sitting on cash, I've happily traded HM1 and FGG. But those are off-limits to WAR.

There are plenty of short-term trading opportunities too, but only for individuals, they won't move the needle for a $225m fund. For example, in a 6 month period I made a ~25% return trading PIA. WAR just held its ~$20m position throughout this huge trading range.

The reality is WAR can't, won't, or doesn't currently have the capacity to, take advantage of most short-term CEF trading opportunities.

(g) True expertise in assessing ASX LICs and LITs?

WAR's prospectus claims Wilson Asset Management, and Geoff Wilson in particular, have significant expertise in realising value from ASX LICs and LITs. However, most ASX Closed End Funds are equity funds and, as I demonstrate on the blog, they underperform passive/systematic exposure to the same markets via low-cost ETFs. Most of this underperformance is due to the gap in Total Expense Ratios (TERs) so it is actually a fool's errand to think that these equity CEF discounts will experience major reversion because they are over-sold. Their discounts may fluctuate but almost all are on a downward spiral since the July 2020 ban on CEF selling commissions.

The few opportunities in ASX CEFs, where the discount can temporarily get so large that holding exposure longer-term to the CEF can be a worthwhile investment, are usually in other asset classes: private equity, credit, alternatives.

For example, the CD private equity funds. Between June 2022 and June 2023, WAR added 0.7% positions in CD2 and CD3 and they now appear in the monthly report's Top 20. However, the positions aren't getting any bigger and, at such tiny proportions, will never move the needle on WAR's returns. Yet, timing entry into the CD funds has delivered some of the greatest returns in the last few years out of all 90 ASX CEFs. But they are very complex to assess accurately and get ahead of major NTA moves and distributions. True experts are across the complexity and can prove it. For example, see my site: CD Private Equity Fund Insights

And, take note, that discount reversion has not been the way to make optimal returns from the CD Funds. They almost always trade at enormous discounts. The exceptional returns have come from distributions at NTA as the funds wind down.

(h) Equity CEFs deliver ~10% returns per year?

In the WAM Strategic Value Q&A Webinar 2023 video (39min mark), Geoff Wilson is asked why he doesn't try and neutralise WAR's equity exposure given the core strategy is discount reversion? His answer is that on average (over the long run) equity markets deliver returns of ~10% a year so it wouldn't make sense to give up this underlying return ("free kick of 10%").

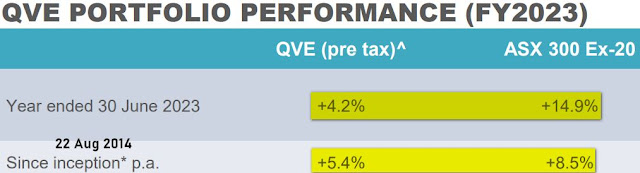

Firstly, assuming future long term equity returns will deliver anything like 10%/year is wildly optimistic and not based on any substantive assessment. But this strategy (not to neutralise) combined with WAR's limited CEF discount reversion activity (thus gains) means that, currently, WAR largely delivers the returns of its portfolio. I analyse its portfolio below and explain how the underperformance of most of its major holdings is driving its NTA returns (-0.85% annualised from 30 Jun 2021 to 20 Oct 2023).

WAR's Portfolio as of 30 Sept 2023

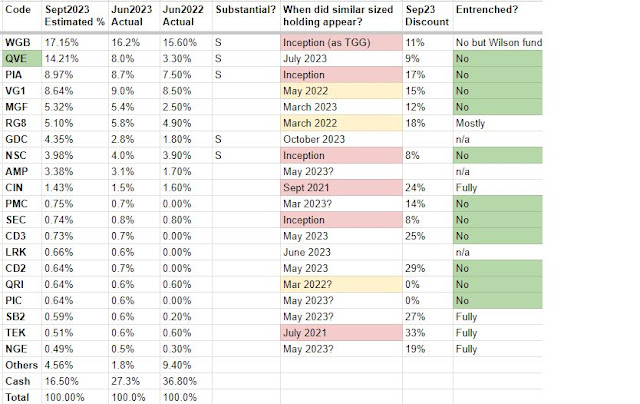

WAR's portfolio as of 30 June 2023 (annual report) and my updated estimates for 30 Sept 2023 are below:

|

| WAR Portfolio analysis as of 30 Sep 2023 |

I will add more detailed analysis at a later stage (e.g. WGB underperformance since WAR acquired its stake but didn't sell it off; Underperformance for QVE, PIA and VG1 since WAR acquired the stake). For now, some bullet points below:

- Note how tiny most WAR positions are (that still appear in its Top 20 in the monthly reports). All but 9 positions are under 1.5%. WAR has ~20 positions from 0.1% to 0.7%, mostly LICs and LITs. At this size, none of these positions can make non-trivial contributions to returns. Instead, they allow WAR to appear much more active than it is.

- It is noteworthy that similar size holdings for WGB, PIA, NSC, CIN, SEC and TEK date from no later than September 2021, mostly from inception (July 2021) when WAR inherited its original portfolio from other Wilson Asset Management funds. WAR has hardly touched these holdings since it launched!

- Similar size holdings in VG1, RG8 and QRI date from around March-May 2022. WAR has hardly touched these holdings either.

- To still have virtually all of the WGB shares from the Oct 2021 scrip merge with TGG, is a reflection of the conflict of interest Wilson Asset Management faces whenever its LICs are involved in takeovers/mergers where WAR has holdings. WAR doesn't wish to sell down WGB as WGB has traded at persistent, significant discounts due to massive underperformance and the overhang of ex-TGG shareholders all wishing to exit.

- Of its large current positions, the only major recent activity has been in QVE (8% to 14.2% since June 2023). (The next largest change is a minor 2.9% increase in MGF since June 2022). An exit near NTA for QVE will only capture a 9% discount reversion (less than 2c addition to WAR NTA); meanwhile, QVE's underperformance, while WAR has been holding it, has been enormous. Any QVE exit will have taken WAR years to hold so QVE's underperformance will outweigh the discount gains.

|

| Perhaps WAR managers should just read the QVE announcements? (25 Oct 2023) |

- Wilson Asset Management appears not to understand how critical underperformance holding costs are in trading CEF discounts. Both VG1 and PIA have been disastrous LICs to hold waiting for an exit near NTA given the scale of their underperformance. Yet, Geoff Wilson appears to have a favourable view of PIA's fund manager and views it as worthwhile exposure at the right entry price:

|

| Wilson Asset Management: May 2022 WAR Webinar transcript |

- Geoff Wilson is similarly sanguine about VG1 and RG8 ultimately closing their discounts through performance and the stewardship of Regal Funds Management and Phil King. Again, Wilson Asset Management appears not to collate the facts about CEF performance and assess them with regard to the costs of holding the exposure instead of building a substantial stake and then pushing for a conversion to an Open End fund trading at NAV:

|

| Wilson Asset Management: May 2022 WAR Webinar transcript |

- Let's not forget what the "king of LICs" has to say about Alex Waislitz and Thorney Technologies (TEK) and Thorney Opportunities (TOP). WAR owns a 0.6% position in TEK and 0.2% in TOP. A cynic might suspect these tiny positions are used to influence other investors to buy, but WAR never builds a decent stake in TEK or TOP even when discounts are over 35%! What Geoff should be doing is publicly pressuring Waislitz to finally let his investors exit near NTA after all these years of having tens of millions in fees extracted while suffering appalling performance. Instead, Geoff pronounces TEK and TOP are "exceptional value" and says "Thorney Technologies is cheap, we may as well buy some more around this discount" but never follows through!

|

| Wilson Asset Management: May 2022 WAR Webinar transcript |

- Note that some WAR investments will not appear in annual reports as they are bought and sold between the 30 June snapshots. Examples include: MHH, WIC, OZG, AEG. It would be desirable for WAR to disclose how large a position it established in these short-term trading opportunities and how many cents they added to NTA. Given WAR's overall NTA performance since inception, my assessment is that WAR did not manage to build significant enough stakes to really move the needle on returns.

Links:

> Livewire: All's fair in love and WAR: What's next for Geoff Wilson's latest LIC

> AFR: Geoff Wilson claims first victory in his new LIC WAR