Summary: If you search for ASX LICs or LITs, you'll find few websites with any significant coverage these days, as the CEF sector dies off. The FIRE bloggers discovered passive ETFs were superior, the industry body LICAT has given up posting, the ASX site is an outdated joke, Rask Australia produces occasional content but admits they don't own any, Bell Potter ceased its monthly writeups, and even Scott Pape killed his darlings, That only leaves sporadic Morningstar / Firstlinks (Graham Hand) articles and Livewire. And Graham Hand basically agrees with me that many LICs/LITs should close.

Thus, Livewire is the last bastion of LIC/LIT promotion. It claims it is "levelling the playing field by giving all investors access to high-value investment insights, commentary and analysis from Australia’s leading money managers." But if this is a valuable service to investors, why doesn't it monetize it?

The reality is that Livewire's product is its readers: investors and financial advisors. Fund managers pay it to refine and publish content that results in fund inflows or demand. Maximising fund inflows to maximise Livewire's long-term profitability and growth is the overriding objective.

Ok, so Livewire is fully focused on fund inflows, but just how much are investor interests sacrificed? This is a mystery, as investors aren't experts with super-powered insight, and are unaware of the hidden decisions Livewire takes, such as censoring inconvenient facts, critiques, better alternatives or complexity.

I'm uniquely positioned to answer this question for just one sector where I have superior expertise: ASX Closed End Funds (LICs and LITs). After the most recent example of Livewire censoring critical facts I tried to add as comments, I will now be regularly updating this post to police misleading content Livewire publishes about ASX Closed End Funds.

|

| If you don't know how the active management game works, guess who the target is? |

Details:

1. Livewire censors comments that provide facts that don't fit the fund manager's story or validly question the fund manager's credibility or motives

Oh, you didn't know Livewire censors inconvenient facts in the article comments, even if they are 100% proven and easily checked?

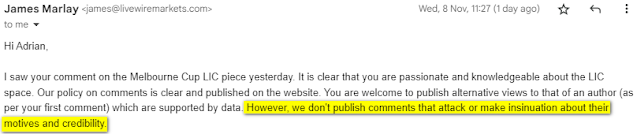

Well, here's Livewire's co-founder, James Marlay, in an email to me regarding my comments on this article:

> Affluence Funds Management: The Melbourne Cup Guide to LICs 2023 (Daryl Wilson)

"I'm aware Affluence has performed well trading in and out of LICs and LITs. So have I. Genuine expertise and significant time and effort is needed to do so. However, it's a zero sum game. Our gains are other's losses. I'd estimate over 95% of retail LIC/LIT investors underperform the passive ETFs they could be investing in instead.

I would make much more money if there were more LICs/LITs, more retail investors in them, and more frequent buying/selling. Instead, I use my CaptiveCapital site to provide the facts to help kill off virtually all ASX Closed End Funds and warn retail investors to avoid them. Conversely, Affluence regularly publishes articles like this (and its LIC Guide) promoting LICs/LITs as investments. Obviously, the few sharpies making money trading LICs/LITs need them to persist (with all of their inefficiencies), and need naive punters in the market (e.g. buying what they already hold, but they'll receive no warning when the sharpie is selling!)

Retail punters may wish to search for "pool of victims" and "alpha". You'll eventually discover what the real evidence says about active management, and discover books like the "The Incredible Shrinking Alpha" and "Winning the Loser's Game."

I responded to James' email by providing the facts to fully back up my comment. Unsurprisingly, James never replied. The key part is my last paragraph and image which proves Affluence has already built its positions in PMC and TGF, is now recommending them to a large retail audience through Livewire, but has never provided advance notice when it decides to sell. Daryl revealed in his article comments reply to me that "making money in LICs is not about buying and holding" so the ethics of Affluence's opportunistic trading, given its current approach to using Livewire, are more than questionable. Perhaps James or Daryl would like to ask ASIC for its opinion?

As for the implication of my comment that, unlike me, Affluence is a sharpie that promotes investing in LICs/LITs that it already owns but will not warn punters when it's selling. That's just another simple fact. If Livewire was operating ethically, authors would have to make proper disclosures of financial benefit and conflicts of interest. It is a simple matter of record that Affluence uses Livewire to promote investing in LICs/LITs it has already built positions in but never provides advance notice when it is selling out of those same LICs/LITs. Indeed, Affluence has never made any commitment that it won't sell (say for at least 3 months) any position it promotes as worth buying on Livewire or elsewhere.

Below are the first four paragraphs:

<<

"Conversely, Affluence regularly publishes articles like this (and its LIC Guide) promoting LICs/LITs as investments."

- This is an incontrovertible factual statement. The focus is on the word investments. Daryl Wilson replied to my first comment by stating "In our view, making money in LICs is not about buying and holding". I am simply pointing out here that Affluence's consistent promotion of LICs/LITs on Livewire (including in its LIC Guide) is as investments. It would come as a surprise to Livewire's retail readers of Daryl's articles that he actually doesn't think they are worth buying and holding. He's never argued that in any of his many articles, and I can point to numerous Affluence statements which state the opposite.

"Obviously, the few sharpies making money trading LICs/LITs need them to persist (with all of their inefficiencies), and need naive punters in the market (e.g. buying what they already hold, but they'll receive no warning when the sharpie is selling!)"

- Affluence isn't mentioned in the above statement, so first assess it generally. The general principle is factual and applies to all "sharpies" using expertise, time and effort to profit off inefficiencies in a market. They need less informed buyers/sellers on the other side of their trades. Moreover, in many Closed End Funds there is abysmal liquidity (market prices are not set by large informed buyers and sellers), so this situation is particularly open to exploiting retail investors. Trading most of the LICs/LITs Daryl mentions is nothing like trading an ASX300 company. The chief theme of "The Melbourne Cup of LICs" each year is: take a punt on these "exceptional value" LICs at big discounts. The relevant facts behind the discounts are never provided in the article or as a link to investigate further. To quote myself on those relevant facts: "true performance figures (NTA, TSR) against passive ETFs, actual Total Expense Ratios, Blocking Stake percentages, facts about abysmal Exit Liquidity, and massive hidden pitfalls."

- So, inarguably, sharpies trading the LIC/LIT market do benefit from naive punters in the market. My comment makes clear that I am one of those sharpies myself. I know exactly how dangerous the LIC/LIT market is for naive investors.

>>

2. Livewire allows fund managers to publish "facts" that are selective, misleading and self-serving

Livewire articles reliably omit the facts that actually matter in deciding whether to invest in LICs and LITs: Actual Performance Figures after all expenses (NTA, TSR) versus passive ETFs; Actual Total Expense Ratios; Blocking Stake percentages; Facts about abysmal Exit Liquidity; Hidden pitfalls and leakages.

Instead, Livewire lets fund managers publish their own version of "facts" about critical things like performance that are selective, misleading and self-serving. Fund managers get to cherry pick the periods they use. They rope in a prior unlisted fund but only if it increases apparent performance. They often use performance returns that aren't after all expenses. They never compare their performance after all expenses to the cheapest, passive ETF alternatives. Indeed, if they provide comparisons, they are often inappropriate (different risk/beta) and usually selective.

For example, in this article:

> Ophir Asset Management: LIC & LIT premiums and discounts: danger or opportunity? (Andrew Mitchell)

Andrew Mitchell claimed: "As you can see OPH is somewhat of an outlier in that it has the best performance since its inception of the peer group (FE Fundinfo data) but also recently at the end of March was trading at a significant discount and close to its largest discount since listing."

Indeed, Ophir's self-created graph asserts impressive performance of around 13.5% per annum from 1 Aug 2015 to 28 Feb 2023.

However, OPH (its LIT) listed in Dec 2018. Fund managers are notorious for including prior periods when a similar unlisted fund existed but only if it boosts their performance. This also makes these contrived performance figures unfeasible to cross-check.

If the OPH LIT is worth investing in, it needs to be able to stand on its own feet.

We can then readily use Sharesight to check OPH's Actual NTA performance or TSR performance since 18 Dec 2018 to any period. As OPH trades at a discount, I have used its NTA performance as it is higher than its TSR performance.

From 18 Dec 2018 to 28 Feb 2023 OPH's NTA performance was 10.27% annualised. This is a significant difference to the claimed 13.5%.

And now for the full period to present. From 18 Dec 2018 to 3 Nov 2023 OPH's NTA performance was 8.65% annualised compared to VAS at 9.34%.

This is far from Ophir's only sin since launching an ASX Closed End Fund. OPH is the only CEF out of 89 that issues DRP shares at NAV when it is trading at a discount!

See: > Ending the CEF Dividend Reinvestment at NAV ripoff

Imagine if I tried to simply and politely state these two facts (actual performance, the DRP pitfall) in a comment on an OPH Livewire article? I know from past experience, there's no chance they'll be published. But they're pertinent facts for investors, isn't that what Livewire is all about? 🙄

I hope Livewire readers are starting to catch on as to how the active management game works. The vast majority of the financial services industry feeds off the myth of active management outperformance. Livewire, like all for-profit publishers of free investing content, are not on the investor's side.

3. Livewire allows conflicted investment research firms to publish one-sided misinformation about LICs and LITs

Independent Investment Research (IIR) is the main, regular purveyor of one-sided "research" about LICs and LITs. Retail investors might presume independent analysis but all such firms are actually paid by the fund managers to provide reports and recommendations.

Perhaps because of an unusually high dependence on LIC/LIT manager revenue, IIR is the most shameless in its one-sided "research and analysis." As just one example, compare Lonsec's report on Pengana Private Equity Trust (PE1) with IIR's. Lonsec at least gave PE1 a light touch-up in the details, while IIR deliberately omits and obscures the major pitfalls.

Indeed, these days IIR actively plays defence for the LIC and LIT fund managers - including against critiques I publish on this site and cross-post on Hotcopper to get the warning out. I can't link to or summarise these critiques on any financial media website as they all protect the hand that feeds them.

Consider the most recent Nov 2023 report that Livewire published from IIR:

> Independent Investment Research: Listed managed investments - restructures on the menu (Nov 2023)

(a) I revealed one of the most hidden pitfalls of LICs (tax leakage) and a chief reason most funds chose to list as LICs rather than LITs (which are much more tax efficient for investors).

> LSF - L1 Long Short Fund - Cheat Sheet

Even during periods they are successful, there are large leakages (e.g. tax) and many LIC managers are loathe to reduce the tax leakage as it also means reducing the capital they charge fees on. The higher the fees/TER the less likely a LIC manager is to efficiently return franking credits.

And this is what is published in the IIR Nov 2023 report about LSF:

"LSF has a high level of dividend coverage with the company paying an increased dividend in each semi-annual period since it commenced paying dividends in FY21. LSF banked a large amount of reserves due to the strong portfolio performance in FY21. The company has been diligent with its dividend payments, slowly increasing payments over time to ensure that the reserves and franking credits are sufficient to allow for the dividend increases."

The reality is the complete opposite as I expose in my LSF blog post:

L1 Capital does not want to pay over a $1/share in dividends to release the over 30 cents/share in franking credits. At $1/share this would be a loss of ~$611.16m in captive capital on which to charge its enormous management and performance fees.

This shameless misinformation should be embarassing for IIR and Livewire when exposed. But, remember, incentives matter. IIR and Livewire feed off retail investor's hard-earned money. They don't exist to protect it.

(b) On this site, I also expose LIC fund managers that have never paid dividends. Over time this results in major tax leakage for investors:

Thus LICs are subject to massive tax leakage, yet the decision on returning it via franked dividends is totally up to the manager! Dividends reduce the assets on which fund managers charge fees, so LIC's have a perverse structural incentive baked in. Indeed, some ASX LIC managers have never returned tax leakage by simply never paying dividends (e.g. GFL, TEK, NGE, ZER).

But because GFL pays IIR to provide a research report, and which has resulted in an IIR rating for GFL of Recommended +, IIR's Nov 2023 report defends GFL not paying dividends by stating:

"GFL’s largest investment is a passive investment in Berkshire Hathaway shares which do not pay dividends. As such, the company does not pay a dividend."

This is a ridiculous statement for a supposed expert in LICs to make. LICs can pay dividends from any source of gains, including capital gains. At bare minimum, GFL should be paying dividends simply to return tax leakage. GFL has existed since 2006 and has gotten away with this ripoff for over 17 years! It is an entirely redundant LIC with a pitiful $29m market cap, high Total Expense Ratio, appalling Exit Liquidity, and Manny Pohl has a 47% Blocking Stake so an investor buying in will be dependent on another foolish buyer to exit.

4. Livewire promotes the myth of active management outperformance

If investors understood that active management almost always underperforms after costs, and that they can't pick the exception funds or managers in advance, then most of the financial services industry wouldn't exist. Livewire is worth nothing without the myth of active management outperformance. Vanguard certainly isn't going to pay Livewire to publish content!

Livewire's testimonials remove any doubt about who it's working for: fund managers focus on the inflows generated from Livewire content (aka campaigns):

|

| Livewire Marktes: Solutions |

|

| Livewire Marktes: Solutions |

But this "performance" isn't about content accuracy, completeness, or worthwhile signal rather than noise for investors.

For example, in the below Livewire article, Pinnacle defends its LIC Plato Income Maximiser (PL8) from Chris Brycki of Stockspot who argued passive ETFs were superior.

> Livewire: There's no such thing as bad publicity (apparently). <Pinnacle Investment Management>

Chris Meyer claims the following statement of Brycki's is wrong:

I don't think dividend chasing is a smart strategy. You've got to look at a total return basis. And for me, it's an avoid. Just use an index dividend-focused ETF instead.> Chris Brycki commenting on PL8

Meyer then compares PL8's performance to HVST and VHY from 5 May 2017 until 23 July 2021 and finds it did better.

Based on this "fact" he proceeds to assert the value of active management via finding skilled active managers like Pinnacle:

"This example neatly portrays what I think is a more balanced view, a view I think is consistent with where the asset management and advice industry has "moved on" to. Active is not always better than passive (VHY has beaten HVST) and passive is not always better than active (PL8 has beaten VHY). Both can co-exist in an investor's portfolio and can serve different and complementary roles. Passive gives you certainty (well not always) of an index return less fees. Active gives you the opportunity (but not the certainty) to outperform an index/objective after fees. Skilled active managers that can do this deserve a place in a client's portfolio. Not all can but many can in the same way that not all shares can outperform the market. Good investing is not only about buying the market at the lowest possible fee."

> Livewire: There's no such thing as bad publicity (apparently)

However, Brycki doesn't actually recommend dividend-focused ETFs as the alternative to PL8. He recommends VAS with its 0.07% expense (tracking ASX300) and, if it establishes a track record of liquidity, index tracking and viability, likely A200 with its 0.04% expense (tracking ASX200).

See: > What are the best Australian share ETFs of 2023?

The reality is that PL8 hasn't outperformed the lowesr-cost passive index funds like VAS since its inception. I establish the actual facts (as opposed to self-serving comparisons) in my analysis of PL8 below. But the biggest issue is that PL8 trades at ~20% premium. Investing in PL8 at this kind of premium has zero chance of outperforming VAS or A200 over any time period longer than two years, and there is a substantial risk of massively underperforming if the premium disappears (as it should given even those committed to the strategy can buy the unlisted version at NAV).

> PL8 - Plato Income Maximiser - Cheat Sheet

Links:

> AFR: How self-directed investors tap into ‘wisdom of the crowd’